- March 19, 2019

- Jeff Lazarto

- Reading Time: 6 minutes

Many companies considering Human Capital Management (HCM) and Finance (FI) digital transformations have evaluated Workday and Oracle SaaS solutions. Both Workday and Oracle have greater market adoption in the services industries, whereas SAP’s solutions grew from a supply chain focus and therefore have been adopted primarily in product industries. This is not to say that these vendor solutions are only found in these respective industries, but for the purpose of our evaluation, the focus will be on Workday and Oracle, as they compete head-to-head more often, especially since both provide HCM and FI cloud solutions.

Workday has grown tremendously as a relatively new company focused initially on cloud HCM solutions and then gradually expanding from HCM to now include Finance, Planning and Analytics. Oracle, on the other hand, developed the best database technology, then parlayed that success by acquiring ERP application providers like PeopleSoft and JDE. They also expanded into other business applications – all of which were on-premise solutions. Oracle then used its Fusion development program and re-designed and re-wrote all of the code to create a cloud-specific solution. Oracle’s growth levels do not compare to Workday’s due to Oracle’s tremendously large installed base, plus last year Oracle stopped reporting SaaS and other cloud numbers separately which makes it virtually impossible to accurately determine Oracle’s cloud growth.

Even so, there has certainly been much more excitement and market buzz around Workday than Oracle. The following is a look at 3 key areas that routinely factor into customer decisions, along with firsthand observations from working with our clients.

How Workday and Oracle Manage Customer Relationships

A key consideration for customers is the ease of doing business with a vendor coupled with how they feel they are valued and being treated by the vendor during sales cycles and over the course of the relationship.

Workday has been doing a great job in this area so far. Being a newer and smaller player, this is not a surprise, as companies in this stage of their growth generally need to be more customer-centric to survive and drive growth. Workday has dedicated customer sales teams and they are readily willing to bring in executives to meet with customers and address questions or concerns they may have. Workday’s 98% customer satisfaction rate is a testament to their success in this area. They also do a good job on the commercial side, providing pricing transparency when requested and demonstrating a reasonable level of flexibility when negotiating commercial terms. Workday has also taken the proactive approach of developing and providing a frequently asked questions (FAQ) document that accompanies their MSA and provides information on some of the key terms.

Oracle, on the other hand, is notoriously poor when it comes to customer relationships. Sales people are routinely moved from one account to another and we often hear customers tell us that the team that sold them the solution is no longer available to them within a year or two after the deal is closed, sometimes even shorter. So when a customer has questions or concerns, they have to start from the beginning to develop relationships with the new team. Of course, the new team’s focus is on new sales, not on addressing concerns from a prior sale where they did not earn the commission.

Oracle has raised support fees annually and threatened audits to manufacture new sales opportunities, both of which has soured customers’ perspectives of their Oracle relationship. We have heard from many companies that they would prefer to move away from Oracle over time, citing their Oracle relationship and the difficulty in doing business with them as reasons for the shift.

From our perspective, Workday is the clear winner when it comes to customer relationships. It’s not even close.

Product Vision

Here we considered the type of challenges that customers are looking to address as they transform their businesses to compete in the next generation marketplace. HCM and FI challenges have evolved from back-office operations with a focus on simply automating these routine processes, to being more deeply integrated with the front of the house and helping business leaders make smart decisions that drive growth and profitability.

For the CHRO, it is no longer simply about performance of administrative tasks, but ways to measure and enhance employee engagement and satisfaction, thereby improving employee productivity and retention. For the CFO, the focus has shifted from recordkeeping and reporting to enabling the business to plan, execute, and analyze performance across the entire enterprise. This is what is meant by digital transformation of the business.

Workday has demonstrated a digital transformation vision for its solutions, especially with the acquisition of Adaptive Insights, which Workday has adopted as its planning solution. Clients have been very impressed with Workday’s vision and solution capabilities and seem to have more confidence in their ability to drive enhanced operational performance.

Oracle has cited that greater productivity has been the primary driver of their SaaS deals, more so than cost reduction, so Oracle does have a focus on improving business performance. However, Oracle’s approach of essentially taking their prior on-premise solutions and rewriting the code for cloud seems to have left clients wanting more. Oracle is also at its core a database company, as all of their business application solutions have been through acquisition. Oracle started with a focus on building an end-to-end cloud infrastructure and then rewriting their applications to run on this cloud infrastructure. One can make the argument that Oracle’s SaaS is more of a technology-focused solution rather than a business transformation-driven solution.

From our perspective, Workday’s vision is resonating better with customers. However, Oracle has a far more robust SaaS solution outside of just Oracle Cloud Financials and Oracle HCM, although Workday has plans to continue to develop and expand its offerings. It appears that customers who value a more complete offering are selecting Oracle, while customers valuing a more transformative solution are choosing Workday.

Oracle v. Workday Product Performance

Even if a vendor has a great company vision, what matters most is if the solutions actually work and perform as expected. Part of this includes the ease, time, and cost of implementing the solution.

From what we have observed, customers are very satisfied with Workday’s solutions. We have not heard of any major performance issues or that certain capabilities or functionality were unavailable or not working properly. Workday’s 98% customer satisfaction and 100% retention rates demonstrate this. Additionally, Workday keeps adding Fortune 500 clients to its customer base along with many customers expanding their initial HCM solution footprint with FI, Planning, Analytics, Recruiting, etc. Workday has also focused on reducing implementation costs and they recently announced that over 70% of their customers are in production.

Oracle has had more challenges. Multiple customers express frustration over the difficulty in implementing the solutions, including rising costs. Customers have also complained about functionality not working as promised, with only partial capabilities. It appears in Oracle’s haste to be able to claim they have the most complete cloud ERP offering, they have not migrated all of their on-premise functionality to their cloud solutions but are doing so in waves over time. We believe this stems from Oracle cobbling together many on-premise business application solutions they acquired over time, then trying to merge the best features from each and rewriting the code to create one cloud offering. This is not an ideal approach, taking applications that were not designed to work together nor designed for the cloud and trying to create a cloud solution.

Contrast this to Oracle’s technology approach, where they spent billions of dollars to design a completely new cloud-specific infrastructure with built-in security features. While this is still relatively new, we have not heard any complaints. Oracle is also a technology company at its core, while applications have been purchased and most of the top talent in designing those applications have left the company.

From our perspective, Workday’s product performance has been superior to Oracle’s as it relates to their HCM and FI SaaS solutions. We believe this stems from their respective company cultures and vision.

The Faceoff

As it relates to SaaS, Workday wins the tale of the tape based on the factors evaluated. This does not mean that we recommend Workday over Oracle, as each organization needs to determine which solutions and vendors are best for them, and there may be other factors to consider and different priorities. Overall, our point of view is based upon our observations from the field to date. In light of the differences between Workday and Oracle as vendors, their respective business practices, and the complexity of structuring proper long-term SaaS agreements, we cannot reinforce enough the importance of ensuring customers have disciplined, holistic and well-staged approaches for how they evaluate, negotiate and structure relationships with their key SaaS vendors.

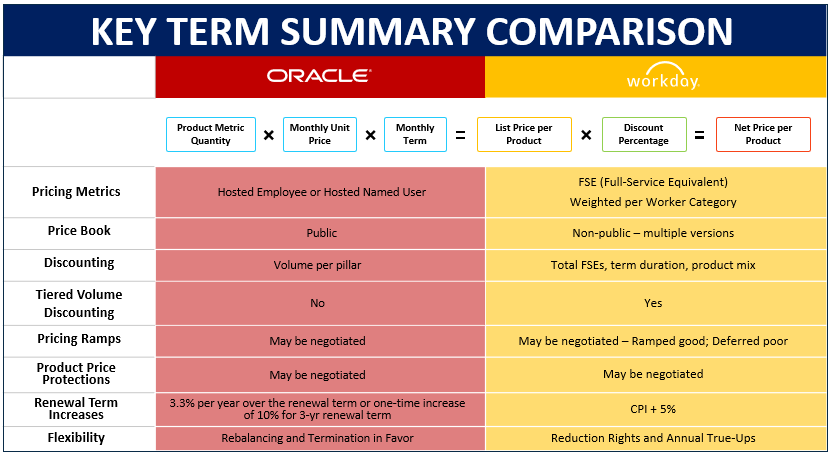

The table below shows a key term comparison to help illustrate the high-level differences between how Oracle and Workday price and discount their products. But again, there are many nuances to understand when evaluating your options.

In full disclosure, UpperEdge has no financial relationships with any of the vendors we cover, including Workday and Oracle. While we do not recommend particular vendors, we assist with a comprehensive evaluation process, analyzing the information presented by vendors as just one component of a company’s overall vendor selection process.

Post a comment below, follow me on Twitter @jeffery_lazarto, find my other UpperEdge blogs, and follow UpperEdge on Twitter and LinkedIn.

Related Posts:

Related Blogs

Evaluating Workday’s LDP: Critical Insights for Small & Mid-Sized Businesses

3 Common Mistakes When Counting Your Oracle Named User Plus License Requirements

NEW: Obtain Oracle SaaS Pricing with Free Estimate Calculator

About the Author