- UpperEdge

- Reading Time: 5 minutes

The consulting industry as a whole took a hit in 2020 as businesses postponed or canceled projects to reduce costs in response to the global pandemic. Here we take a look at how Accenture in particular was impacted, what actions they took this year that customers should be aware of, and what customers can expect from Accenture as we move into 2021.

Accenture’s FY20 Financial Performance

Despite many 2020 projects being halted, Accenture reported record bookings for the year at $49.6B ($14B in Q4 – Accenture’s second highest quarter ever) and finished out its fiscal year with a 3% increase over last year.

Though CEO Julie Sweet stated they had an incredible year going into the end of February, growth dropped once businesses started reacting to the rising pandemic. Accenture played defense by implementing cost-cutting staffing changes which helped soften the blow, but most of this year’s growth was actually driven by acquisitions.

Staffing Changes

It’s not unusual for system integrators to replace their “low performers” with new talent each year. However, the staffing changes Accenture made this year differed materially from their usual actions. Here are some of the major changes they made in 2020:

- May – Accenture paid out bonuses and gave promotions to more than half of its employees in India, doubling down on their top talent.

- June — Accenture announced a hiring freeze.

- August – Accenture announced layoffs of 5% of their staff which equates to roughly 25,000 employees.

- September — Accenture announced a shift in their strategy with plans to heavily invest in digital transformation and the cloud by committing a $3B investment to its cloud-first division in India with intentions to bring on a team of 70,000 professionals.

In parallel to implementing these staffing changes, the company launched changes to its performance management system which haven’t been received well by some staff. Some disgruntled employees have even voiced their concerns about the new appraisal system on job sites, saying that it is a way to silently lay off more staff.

In an internal global staff meeting, Julie Sweet stated, “This year, in addition to the normal 5 percent (of layoffs), we’ve identified more people who need improvement … So we’re making sure … if we have to make other actions, we know where our performance is.” This statement indicates that we could indeed see more layoffs.

Accenture’s swift and aggressive efforts to reduce or eliminate subpar performers could create short-term talent shortages while Accenture looks to reorganize and advance its cloud-first capabilities through digital transformation investments in India. Customers’ short-term focus should be on ensuring Accenture’s continued commitment to retaining current key personnel on their projects.

While Accenture has taken great strides to restructure their workforce internally, they have also been making several acquisitions that help fuel those areas of highest growth potential. Though they won’t be hiring to replace the 5% of employees they transitioned out this year, acquisition activity could help offset that short-term talent shortage.

Acquisitions Fuel Growth

Keeping tabs on the M&A activity of your key providers is a great way to understand where the vendor may be headed strategically. After making 20 acquisitions in 2019, Accenture continued their aggressive acquisition activity with an additional 24 acquisitions in 2020.

These acquisitions will further enhance Accenture’s digital and cloud competences as well as fortify their global delivery capabilities. For example, the five acquisitions below are each from different countries and cover consultancy services for AWS, ServiceNow, and SAP.

- April: Gekko, an Amazon Web Services (AWS) cloud services consultancy and MSP based out of France.

- August: Organize Cloud Labs, ServiceNow’s first and only elite partner in Latin America. Organize Cloud has shown substantial year-over-year growth of roughly 136%.

- September: SALT Solutions, a technology consulting firm and SAP Gold partner based in Germany.

- October: Zag, a New Zealand-based SAP and cloud solutions technology firm.

- October: Avenai, an Ottawa-based provider of consulting and technology services.

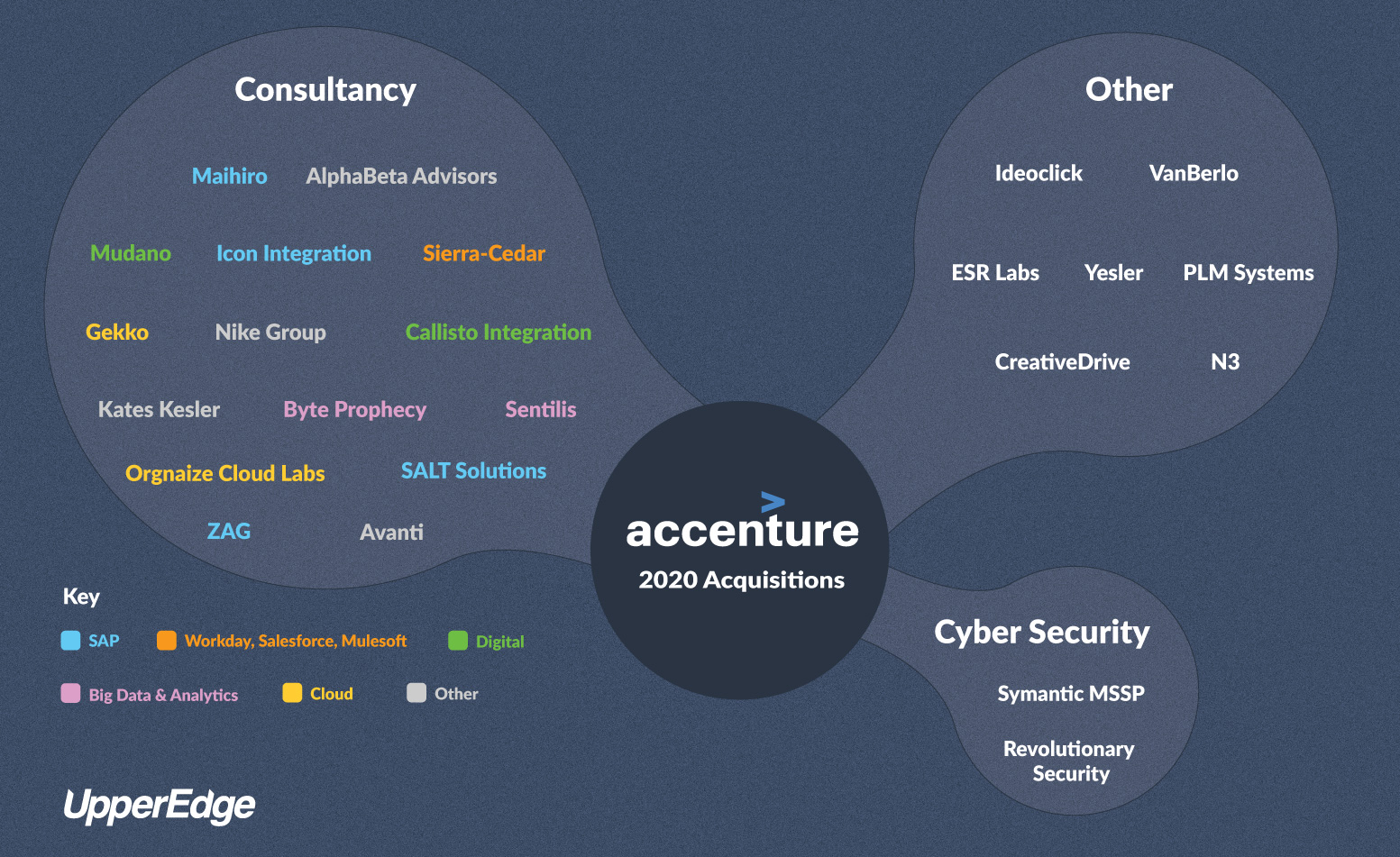

When looking at what was acquired, some key themes come to light. The graphic below groups all 24 acquisitions that were announced in 2020 (as of October 21st) into three high-level categories: Consultancy, Cyber Security, and Other.

You can see there is a predominate focus on cloud-based service offerings for enterprises, big data, and cyber security. More specifically, they are expanding their ability to deliver SAP digital transformation initiatives globally. Some of the acquisitions also align with specific industries such as the automotive and financial services industries. Overall, these acquisitions indicate what Accenture considers to be the areas with the most opportunity for growth.

It’s All About the Cloud

Accenture’s increased focus on the cloud market can also be seen in the massive brand change Accenture just launched. They are putting $90M in an annual budget towards its “Let There Be Change” campaign, developed by advertising agency Droga5, a company that Accenture acquired in April of 2019. This significant investment is triple their normal annual media spend and will support the new growth model that was put in place in March 2020 which includes a leadership team that is twice as large as the previous one.

Accenture has been increasing its focus on the cloud since they set a goal in 2014 to become 70% focused on digital, cloud, and security by 2020. They reportedly achieved this goal in September 2020 which was likely aided by the several acquisitions that aligned with those key themes. Though the pandemic didn’t cause Accenture to shift their overall focus, it has likely given them reason to accelerate their efforts in order to succeed in a suddenly more digital and cloud-based world.

What Do We Expect to See in 2021?

Accenture is putting themselves in a good place for 2021 with their actions of the past year. They have clearly made investments to ensure that they are more than capable of helping organizations worldwide in their digital transformations and journey to the cloud. Accenture CEO, Julie Sweet, says that Accenture anticipates its consulting and strategy business to make a full recovery by the second half of its 2021 fiscal year.

Customers should expect to see Accenture more aggressively pursue digital transformation opportunities where organizations are moving to the cloud to support enterprise applications. While Accenture will likely be competitive on its price points, that may come at the expense of a heavily skewed offshore presence. For some, this may be a welcome relief since Accenture tends to be the highest priced of the top consulting providers when it comes to onshore rates.

Accenture’s enterprising acquisition streak strengthens their domestic talent base in many geographies and increases their delivery capabilities with offshore resources. That said, their biggest challenge pertaining to their resource mix will be successfully integrating resources from their numerous recent acquisitions while onboarding and acclimating a massive offshore digital presence.

Customer Takeaways

- Keep an eye on their rates – Will the expansion of their digital transformation capabilities (through acquisitions of consulting companies) and the increase in their offshore presence (through hires) afford them the ability to lower their rates? Will they lower their rates in an effort to be more competitive in their price points?

- Accenture will increasingly push their cloud–first practice – Will the public’s mindset shift to consider Accenture more of a cloud-first consulting firm as their acquisitions become fully integrated and Accenture’s brand change kicks in?

- Protect project resources – While the acquisitions may help offset a potential talent shortage, customers may notice some of their key resources being pulled from projects so Accenture can put them in front of new potential business. Make a continued effort to protect your resources and hold key personnel accountable.

Accenture has done a great deal internally and externally to improve its delivery efficiency, delivery capability, and worldwide presence in 2020. Overall, they have positioned themselves well to compete in the cloud-first market. As the world continues to move towards a new norm, the improved sense of stability and clarity will allow companies to revisit initiatives that were put on pause. As businesses slowly restart their programs, the need to embrace digital and increase efficiencies remain critical priorities that will need to be addressed.

Post a comment below and follow UpperEdge on Twitter and LinkedIn. Learn more about our IT Services Sourcing and Negotiation Support.