- John Belden

- Reading Time: 8 minutes

The Cost of Losing Leverage

In large-scale IT programs, cost overruns on system integrators don’t come from one catastrophic decision. They come from a series of subtle moments when the balance of leverage quietly shifts away from the client.

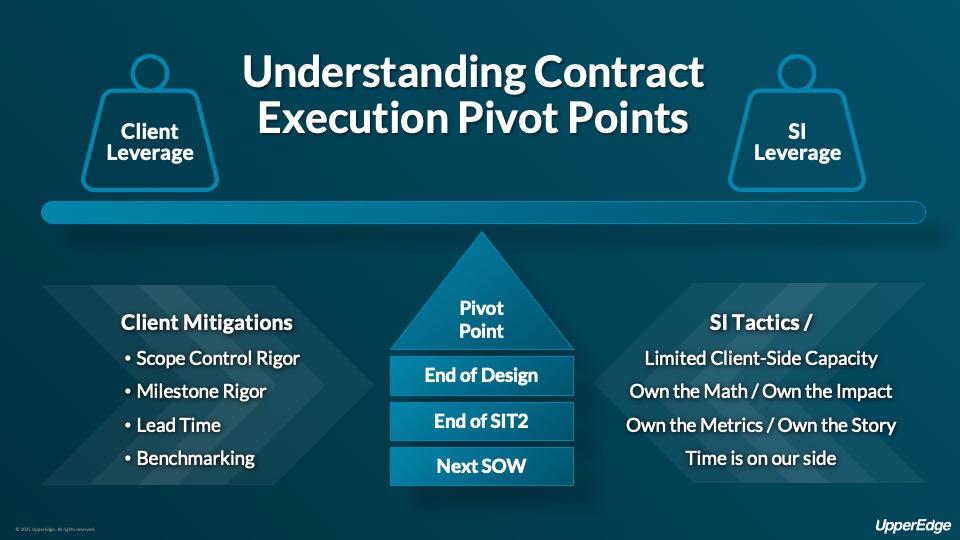

We call these moments pivot points.

They’re not failures. The system may still go live. The implementation might check every box on the project plan. But beneath the surface, costs are quietly expanding, particularly in the fees paid to system integrators (SIs).

Clients typically budget for a 10–15% contingency on SI spend. However, we frequently see SI’s clients spend 50–75% more than originally agreed upon fees. Why? Because they fail to recognize and manage the moments that matter most.

This blog introduces three recurring pivot points, or inflection moments in the project lifecycle where leverage changes hands. We’ll show how and why they occur, the consequences of missing them, and what smart clients do to hold their ground.

These insights come from real-world experience, supported by anonymized case studies, and are the foundation of our upcoming webinar and our Project Execution Advisory services.

What Are Pivot Points?

Every IT program is built around hundreds of decisions—on scope, timeline, staffing, integrations, testing, training, and more. But not all decisions carry equal weight.

A pivot point is a moment during program execution where leverage shifts, usually from the client to the system integrator. These shifts often go unnoticed in real time. There’s no warning light. No meeting titled “pivot point.” But the consequences are lasting.

At these points, small choices, or lack of action, set in motion much larger cost dynamics:

- The die is cast for change orders expansion.

- SI accountability weakens, reducing their risk profile.

- SI teams linger longer than planned on the client’s dime.

- The next phase starts from a position of weakness, not control.

Crucially, pivot points are not random. They’re predictable, recurring across industries, platforms, and SI partners. And they don’t show up on a Gantt chart.

The good news? With the right structure and foresight, they can be anticipated and, more importantly, controlled.

Pivot Point #1: After Design Sign-Off – When Scope Hardens and Leverage Slips

The first major pivot point in most IT programs occurs at the close of the design phase. It feels like milestone: the documents are signed, decisions are made, and the team moves into execution mode. But this is when leverage starts to shift.

Until this point, the program has been in a relatively collaborative posture. Assumptions are being explored, options debated, and scope is fluid. But the moment the design is finalized, that fluidity ends and the SI gains a powerful advantage: scope becomes a contract boundary.

Most clients don’t recognize how much ground they lose here. So how does this happen?

Clients Track the Adds, But Miss the Subtractions

During design, scope changes constantly due to new reports, additional workflows, and extra integrations. These “adds” are documented, tracked, and discussed. We typically see documented scope expansion of 8-15% at the conclusion of the design phase.

But what’s often missed is what came out of scope: functionality that was deprioritized, misunderstood, or kicked down the road. Cleary defining the new “out of scope” can significantly reduce the impact of the scope increases. What makes matters worse, if clients do not address what is out of scope at the conclusion of design, they often resurface later as change orders that the client is on the hook for.

Client-Side Capacity Isn’t Recalibrated

Design changes impact more than the system—they affect the entire downstream workload. More functionality means more testing, more training, more change management, and more business involvement.

Yet clients rarely adjust their internal resource model post-design. The result? Client teams are stretched thin during Test and Deploy, critical client related work falls behind, and the project is delayed due to a “client delivery problem.”

This isn’t a delivery issue—it’s a capacity planning blind spot.

SIs Provide Partial Financial Views

It’s common for SIs to provide an updated cost estimate after design, but only for the next phase or just the initial deployment. Without a recalculated total cost of ownership, clients walk into execution under-informed.

If you don’t build your own math, you’ll be reacting to the SI’s version for the rest of the project.

In our upcoming webinar, we will explore how one company’s anticipated SI spend exploded from $70M to $195M following the design phase and how UE assisted the client in substantially reducing forecasted cost structure.

How to Level the Playing Field and Hold the Pivot

- Track scope changes in both directions: For every addition, log what was deprioritized or removed and revisit it before sign-off.

- Recalculate total program cost and internal workload: Don’t just approve the next phase; understand the full downstream impact.

- Build your own internal cost model: If the SI controls the math, they control the narrative.

Pivot Point #2: After Integration Test Cycle 2 – When Accountability Quietly Transfers

The second major pivot point occurs after Integration Test Cycle 2 (ITC2), a milestone that receives far less attention than it deserves. On the surface, it’s just another test cycle. But in practice, this is when the balance of accountability shifts from the SI to the client.

Up until this point, the SI typically owns the heavy lift:

- Build execution

- Test preparation

- Training content development

The client’s role is mostly review and validation. But once ITC2 concludes, the script flips.

Suddenly, the client becomes the driver of critical program outcomes:

- Final testing (UAT, performance testing)

- Data cleansing and migration

- Training execution

- Deployment preparation

- Dry runs and cutover

This shift is built into most plans, so it’s not a surprise. What is surprising is how often clients fail to treat this as a leverage checkpoint.

Why Does This Matter?

The SI’s Primary Delivery Obligations Are Now “Complete”

With build done and test cycles closed, SIs position their major deliverables as complete. If problems emerge during UAT deployment activities, the SI response is often:

“That’s a client responsibility; we are here to support your work”

This subtle handoff creates real risk; unless you hold the SI accountable for their full delivery at the conclusion of ITC2, everything after this point can be blamed on you.

Cost Exposure Creeps In

As delays accumulate in testing or deployment prep, the SI is still billing, often at full burn rates. With limited contractual hooks left, clients are frequently presented with change orders for 1–3 months of extended support, justified as “client-side delays.”

In many cases, those delays trace back to late delivery, unclear documentation, or missed dependencies the SI contributed to, but the burden of proof is now on the client.

Status Becomes a Negotiated Truth

Without formal checkpoint criteria, progress assessments become subjective. Clients may believe the SI hasn’t completed test coverage or defect remediation. The SI may claim their responsibilities are fulfilled.

If you haven’t defined how progress is measured, and who gets to validate it, you’ve lost the pivot.

In our on-demand webinar, we walk through how one global manufacturer lost leverage at ITC2 with the SI presented a change order for $5M to extend the program. We discuss how the client reclaimed some of that leverage and what they did moving forward to not lose the leverage in future deployments.

How to Level the Playing Field and Hold the Pivot

- Enforce a formal checkpoint at ITC2: Define clear criteria to validate build completion, defect closure, and training readiness.

- Capture a snapshot of accountability: Document what the SI was responsible for, and whether it was truly delivered, before transitioning to client-led work.

- Use the checkpoint to renegotiate the path forward: If quality is lower than expected, adjust support terms or re-sequence activities before it’s too late.

Pivot Point #3: Negotiating the Follow-On SOW – When Fatigue Replaces Strategy

The third major pivot point arrives just after go-live, when the system is stabilizing and the focus begins to shift toward what’s next. In theory, this should be the moment when the client regains leverage. They’ve been through the implementation, learned where the SI added value (and where it didn’t), and are ready to reassert control.

But in practice, the opposite often happens.

Clients are stretched thin—still chasing defects, cleaning up data, retraining users, and closing the books. At the same time, they’re under pressure to maintain momentum and secure SI resources for the next phase.

This creates a dangerous vacuum: strategy gives way to urgency, and the next Statement of Work (SOW) gets negotiated in a haze of fatigue, distraction, and partial information.

Why This Happens

Stabilization Consumes All Available Capacity

After go-live, most clients underestimate the sheer weight of stabilization. Defects continue to roll in. Users need more support. Business units push for postponed functionality. And leadership wants metrics.

This leaves little bandwidth to thoughtfully plan or challenge the next SOW. Instead, clients default to what feels easiest: keep the SI team, keep the momentum, and keep moving.

The cost of speed here is high: it’s often a premium-priced, loosely scoped contract.

SIs Exploit the Lull with Two Plays

When clients hesitate, SIs don’t push. Instead, they do one of two things:

- Let the SOW signing slip, while continuing to bill “support” hours at full rates.

- Push through a lightly negotiated SOW just to get under contract—often with inflated assumptions, limited efficiency expectations, and vague deliverables.

Both moves shift commercial risk to the client while preserving SI revenue.

No Internal Efficiency Model Exists

Clients rarely pause to ask: Should the next phase be cheaper? What’s changed?

Instead, they assume similar scope = similar cost. But in most cases, the next phase should cost less:

- The SI is already ramped

- Data models and templates are in place

- Test cycles should shorten

- Training design is reusable

Without a model for expected efficiency, the client walks into negotiation blind—and ends up funding the same effort twice.

In our on-demand webinar, we walk through how one client used an SI Relationship Evaluation Model to reduce their follow-on SOW proposal by over $12M—before the contract was ever signed.

How to Level the Playing Field and Hold the Pivot

- Start early: SOW planning should begin 60–90 days before go-live and before stabilization distracts the team.

- Model expected efficiency gains: Build internal benchmarks for productivity, reuse, and reduced complexity.

- Leverage alternate sourcing: Even the appearance of options (internal resources, niche providers, new RFPs) increases negotiation leverage.

Why Clients Lose Leverage at These Pivot Points

Each of these pivot points—post-design, post-ITC2, and post-go-live—is predictable. They’re not hidden traps. They’re known transitions in responsibility, scope, and planning.

So why do so many clients consistently lose leverage at exactly these moments?

It comes down to four recurring breakdowns:

No Internal “Math” – If you’re always reacting to the SI’s number, you’ve already lost.

Clients often rely entirely on SI-generated numbers, whether for change orders, future SOWs, or total program forecasts. Without internal models, benchmarks, or decision frameworks, clients are negotiating in the dark.

Lack of Real-Time Tracking – A RAID log that’s 30 days stale might as well not exist.

Key data like test coverage, issue aging, defect volume, and training completion often goes untracked or underutilized. Without it, clients can’t credibly challenge SI performance or validate readiness.

Limited Capacity to Challenge – Yes you have the skills, but do you have the time?

Internal teams are spread thin, especially during critical transitions. The people who could hold the SI accountable are the same ones leading testing, data migration, or training. Governance takes a backseat to execution, leaving leverage on the table.

Failure to Enforce Accountability at Milestones – If you don’t keep score, the game is over.

Clients don’t always treat Design Sign-Off or ITC2 as formal checkpoints. Without documented completion criteria and accountability scorecards, the SI narrative becomes the default.

How to Level the Playing Field and Hold the Pivot

You don’t need a bigger team to hold these pivot points. You need structure, foresight, and the ability to step back—at exactly the right moments—to ask: Where is our leverage right now? And how do we protect it?

Here’s what situationally aware clients have learned to do:

- Track scope adds and removals in real time: Know what’s really changed and what that means downstream.

- Treat ITC2 as a formal quality gate: Don’t move forward until what was promised is truly delivered.

- Start next-phase planning 60–90 days before go-live: Build the internal math and sourcing strategy before urgency takes over.

- Benchmark everything: Hours, rates, scope, productivity, and team structure. If you don’t know what’s reasonable, you’ll pay for what’s convenient.

This Is What Project Execution Advisory Was Built For

UpperEdge’s Project Execution Advisory service is designed to help clients:

- Spot pivot points before they hit

- Build the math, data, and governance structures needed to hold leverage

- Strengthen internal capacity without adding headcount

- Avoid change order spirals, post-go-live overpayments, and SI-led timelines

We’re not just advisors—we’re your execution-side negotiators, ensuring your decisions lead to commercial outcomes you can live with.

Join the Webinar – Phase 0 Done Right: Setting the Foundation for a Successful SAP Implementation

In our upcoming session, we’ll:

- Walk through real-world pivot point scenarios, including how SI spend ballooned from $70M to $195M after design

- Show how clients reclaimed leverage mid-program using internal benchmarks and strategic resets

- Share practical playbooks you can use in your own programs

If you’re in the middle of a transformation—or about to start one—this is the conversation you want to have now, not later. Watch the webinar here or explore our Project Execution Advisory Services.

Related Blogs

Why 2026 Will Be a Defining Year for Enterprise SAP Negotiations

SAP Q4 FY2025 Earnings: Five Key Takeaways Heading Into 2026

Program Drift: The Hidden Threat to Your ERP Investment

About the Author