- Jeff Lazarto

- Reading Time: 4 minutes

After IBM’s Q4 2015 earnings release, we posted a piece called “Opportunity Knocks for IBM Customers, But Will They Answer?” on the unique opportunity and negotiation leverage IBM customers will have in 2016 to transform their IBM relationship and negotiate highly competitive agreements. Now that IBM has released its Q1 2016 earnings, here is an update.

The Revenue Decline Continues

IBM recently reported its 16th straight quarter of revenue decline (-2%), even though it beat revenue expectations, and continues to discuss its ongoing process of transforming its business to a cognitive solutions and cloud platform company. But cognitive solutions and cloud revenue growth are still unable to keep pace with the steep revenue decline in its traditional hardware and services businesses.

What is interesting in Q1 is that IBM actually had a unique one-time tax refund of $1.2B in resolution of a long time tax issue with Japan. This lowered IBM’s effective tax rate to negative from its underlying tax rate of positive 19%. The tax windfall effectively offset significant quarterly charges related to workforce transformation, real estate, and Latin America actions. Yet year-over-year operating net income and EPS declined 21% and 19%, respectively. All reported operating margins declined while the tax rate improved dramatically.

While it is true that IBM continues to work through a significant business transformation, these type of results are not encouraging and are making Wall Street analysts skeptical of IBM’s strategy and execution capabilities.

Additionally, IBM recently announced changes to their management system and organizational structure, including their business segmenting structure. This is the first quarter in which IBM is reporting results under this new structure. IBM’s new structure now has 5 business segments: Cognitive Solutions, Global Business Services, Technology Services & Cloud Platforms, Systems, and Global Financing. This is meant to align with how IBM is going to market. But IBM still speaks to growth in what it calls its strategic imperatives, and highlights these separately in their financial charts, but these imperatives are weaved throughout the business segments outside of Global Financing. While this restructuring may very well make sense long-term, one cannot help but speculate if this also serves a secondary purpose of injecting some confusion to mask underlying performance issues.

All the financial maneuvering over the past few years with share repurchases, and rationalization of external factors on performance such as tax rates, currency fluctuations, and foreign governmental issues, can no longer mask the challenges and health of IBM’s underlying business. What this means for customers is increased pressure on IBM executives and sales teams to find opportunities and close deals, even if that means offering non-standard discounting and commercial terms. IBM must grow top line revenue to reverse the current 4-year trend. Time is running out under CEO Ginny Rometty’s watch to turn things around.

Workforce Rebalancing Continues – Impact to Performance and Reputation

IBM continues to rebalance its workforce by terminating employees with skill sets in lower margin businesses that IBM is in the process of exiting, and hiring employees with new skill sets for building new higher margin businesses. This is all part of the long transformation process IBM has been undergoing for a few years now.

Interestingly, in discussing IBM’s services business, Martin Schroeter, IBM’s SVP & CFO, stated that IBM “stayed in these big ERP implementations a bit too long.” This would help explain the workforce reduction in services resources and why we have learned of more problematic IBM ERP implementation projects. IBM acknowledged the price pressures in large scale ERP implementations and is moving to higher margin services and cloud implementation services, with the recent acquisitions of Meteorix and Bluewolf, which specialize in Workday and Salesforce implementations, respectively.

While this workforce rebalancing may be necessary for IBM to achieve this transformation and realize its strategic vision, what seems to be less considered is the impact these actions have had on employee morale, IBM’s services performance, and on customer perception of IBM. We have heard far more negative comments from IBM customers than positive. These recent experiences over the past few years can negatively impact a substantial portion of tomorrow’s generation of IT leaders, many of whom will either no longer consider hiring IBM services going forward or will just maintain inherited IBM services deals until the time is right to transition to another provider. While IBM may state that they are looking to exit some of these businesses as part of its transformation, the reputation damage will certainly have an impact on customers’ willingness to invest in IBM’s newer cloud and cognitive solutions and services.

Higher Gross Margins Present Opportunities to Negotiate

IBM touted its more profitable higher margin businesses and the profit improvement they typically see from the first to second quarter. Last year provided a $1B increase in pre-tax income, and this year with an impact from recent acquisitions, IBM is forecasting a $2B increase in pre-tax profit from Q1 to Q2.

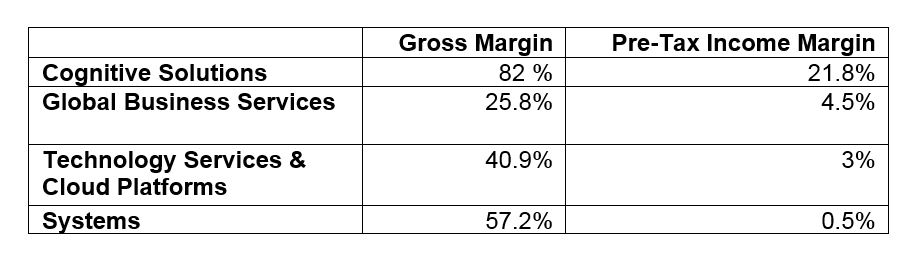

As for margins, IBM reported a Q1 gross profit margin of 47.5% and a pre-tax income margin of 7.3%. Below are IBM’s reported Q1 margins in its 4 main business segments, less Global Financing: It is easy to see the tremendous margin opportunities that cognitive solutions and cloud platform present and why IBM is focused here. But IBM is under pressure to show that they are achieving market adoption and to do so before market competition ramps up and drives down margins. For savvy customers, these inflated margins coupled with Wall Street overall revenue pressure present negotiation opportunities across the full spectrum of IBM’s offerings.

It is easy to see the tremendous margin opportunities that cognitive solutions and cloud platform present and why IBM is focused here. But IBM is under pressure to show that they are achieving market adoption and to do so before market competition ramps up and drives down margins. For savvy customers, these inflated margins coupled with Wall Street overall revenue pressure present negotiation opportunities across the full spectrum of IBM’s offerings.

Related Blogs

Why You Are Accenture, Deloitte, IBM, and PwC’s #1 Priority—But Not in a Good Way

Kyndryl Forcing Migrations to The Public Cloud: What Customers Need to Know to Be Prepared

IBM Divestiture: Who Does it Really Impact?

About the Author