- UpperEdge

- Reading Time: 4 minutes

Winners of the digital evolution will be highly dependent on a company’s ability to innovate and identify with their customers, and to also set up partnerships and ecosystems that support their digital transformations. These partnerships will be very different from traditional relationships, since the underlying transactions, sources, and commercial models will vary from today’s norms.

Digital startups have the agility to innovate but large companies are not as flexible. To differentiate, Fortune 1000 companies will need to leverage their partnerships, digital supply chains, and developing ecosystems to scale in the digital world.

(Customer + Innovation + Ecosystems) @ Speed = DIGITAL OPPORTUNITY

Imagine competitors in the auto industry partnering with infrastructure providers to define digital standards for communications, or even setting standards for transactions across engineering and supply chain processes with their suppliers. These scenarios could:

- Create a high cost of entry for new players

- Drive scalable efficiency from supply chains, or

- Differentiate a product

Companies have merged and or shared distribution networks in various markets to influence these factors and now technology can duplicate this.

Similarly, there are partnerships within an industry that, when combined, can drive scalability and a larger value case in digital transformations. For example, industrial manufacturers have begun to develop communications with their products that are point to point, providing new services, efficiencies, and user experiences. There is an opportunity to develop hubs for these transactions to limit the number of connection points, and to combine and enhance data.

Companies Like General Electric, Siemens, Schneider Electric, and ABB may be the Hubs and Data Service Providers of the Future

Consider the HVAC industry, which enables their products to communicate directly back to the OEM to support new service models, warranty analytics and other services. In parallel, building management system providers are capturing data from building environments for controlling building systems and experiences. The HVAC OEM can receive data directly from the building management system, limiting the number of connections and obtaining additional data relevant to the environment. This service could be exchanged for HVAC analytic interpretation or translation (share of intellectual property) that can be used by building management system providers.

New partnerships will also need to be forged with providers of complementary services such as the auto supplier and the auto insurance provider. Combining services to meet customer or regulatory requirements will need to be addressed for such partnerships to be deemed successful. A good example will be watching the investors in autonomous driving such as Google, Uber, Tesla, General Motors, Ford and others, as they will need to build these ecosystems to scale. If not, where will the auto be serviced or maintained, fueled, and parked, or how will it meet government regulations?

Other partnerships may come from government entities or scholastic institutions. Various levels of government see digital as the way of the future and are investing heavily to boost economies and enable the workforce of the future. Recently Bloomberg reported,

“Sidewalk Labs LLC, the urban innovation unit of Page’s Alphabet Inc., has applied to develop a 12-acre strip in downtown Toronto, responding to a recent city agency request for proposals, according to two people familiar with the plans. Details of the proposal are private, but these people said the bid fits with the company’s ambition to create a connected, high-tech city or district from scratch.”

Toronto, like other cities and other government agencies, is looking to attract digital companies and is looking for companies to build ecosystems to develop smart cities, buildings, things, etc.

Technology software and platform provider partnerships will evolve as the digital evolution migrates away from humans to Artificial Intelligence (AI) technologies. Transactions will be performed by “things” and humans will be partners or customers. Traditional user licensing agreements will phase out as new agreements will need to be created to address how companies interact with technology. The SAP lawsuit of Diageo for indirect access of their platform is the first sign of the change to come, with additional filings by SAP for indirect access already beginning.

The Future for Large Companies

As the velocity of change increases with digital, the need for external and cloud services will continue to increase, to provide an organization with innovation, flexibility, adaptability, and to bridge partnerships, build processes, and afford operational efficiencies. In addition to the services they provide, their relationships and customers will be used to access additional partners and ecosystems. Organizations will outsource key capabilities to keep up with the demands for change in the market.

As an example, Accenture and Schneider Electric recently announced the development of Digital Service Factory:

“This new capability is intended to help Schneider Electric to quickly test and develop new IIoT product offerings. It is a facility in which Schneider and Accenture staff will be able to generate and incubate new ideas for product offerings, such as predictive maintenance tools or asset monitoring suites, bringing them to market in less than eight months, as opposed to the three years this process typically takes.”

Partnerships with product suppliers and distribution channels will change as the need for additional data about products increases. Information from products/components and from supply chains will be required to enable new efficiencies and digital capabilities. These relationships will require developing content for channels, accelerating new product development cycles with collaboration and knowledge sharing, along with embedding capabilities such as 3D printers to build components.

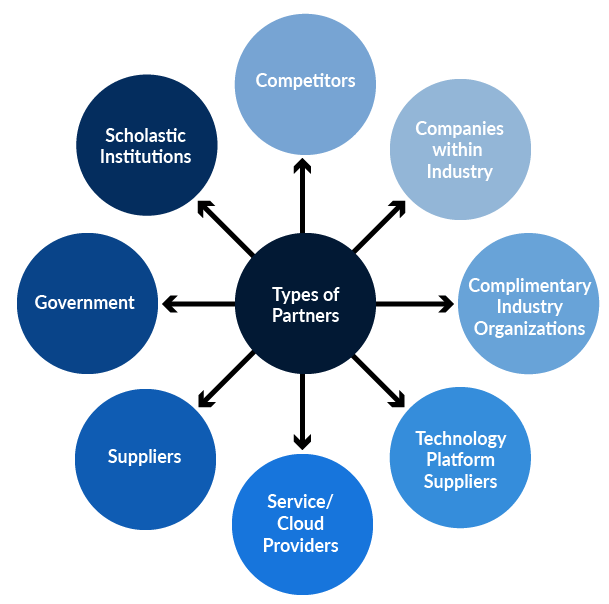

Types of partners include:

Leaders in Developing these Ecosystems Will Become the Winners in the Digital World

Companies can leverage their brand, existing partnerships, their capital and customer loyalty, to build the digital ecosystems to support their businesses. The brand and strength of a company will be dependent on their ability to meet customer expectations and to bring a larger value proposition together with their partners. It is with this scale that digital initiatives will succeed, as small independent ideas will come and go as rapidly as the apps on our phones today. The currency used in these ecosystems will include transacting data, intellectual property rights, sales leads, investments, along with other terms and conditions. With the rapidly changing environment and need for velocity and quality, managing the lifecycle of digital partnerships is essential.

Part two of this blog, Does Sourcing Matter in Digital Ecosystems, reviews the role of sourcing in developing these partnerships and ecosystems.