- Adam Mansfield

- Reading Time: 6 minutes

Microsoft announced a price increase to its Dynamics 365 (D365) suite of products that will take effect October 1st, 2024. Per the announcement, these price increases will impact new D365 customers and existing D365 customers for renewals that happen after October 1st.

While Microsoft may be asserting “added value” as justification for the price uplifts, price increases will also help Microsoft improve a key focus area for them – increasing their Cloud Revenue and Average Revenue Per User (ARPU). Price increases will also help enable Microsoft to obtain profitability improvements and sustainable growth.

Some specific price increases for Dynamics 365 include:

| Product | Current Price | Price After October 1st, 2024 | Percentage Uplift |

| D365 Sales Enterprise | $95 | $105 | ~11% |

| D365 Sales Device | $145 | $160 | ~10% |

| D365 Sales Premium | $135 | $150 | ~11% |

| D365 Relationship Sales | $162 | $177 | ~9% |

| D365 Customer Service Enterprise | $95 | $105 | ~11% |

| D365 Customer Service Device | $145 | $160 | ~10% |

| D365 Field Service | $95 | $105 | ~11% |

| D365 Field Service Device | $145 | $160 | ~10% |

| D365 Finance | $180 | $210 | ~17% |

| D365 Supply Chain Management | $180 | $210 | ~17% |

| D365 Commerce | $180 | $210 | ~17% |

| D365 Human Resources | $120 | $135 | ~13% |

| D365 Project Operations | $120 | $135 | ~13% |

| D365 Operations – Device | $75 | $85 | ~13% |

Note: D365 Business Central and other products not listed above will remain unchanged.

As you can see, these are not nominal price uplifts; Dynamics 365 pricing is going up an average of 17%. Here, I will discuss why Microsoft is increasing the pricing on their Dynamics 365 products, what customers can expect between now and October, and how Microsoft customers can combat these price increases at their upcoming negotiations and renewals.

Why is Microsoft Increasing Dynamics 365 Pricing?

Like their previous Microsoft 365 price increases that were rolled out back in 2022, Microsoft is drawing attention to the value added to the Dynamics 365 products to justify the upcoming price increase. Microsoft’s Corporate VP of Business Applications and Platform, Bryan Goode, said the following in the blog post covering the announcement:

“Each year, we release hundreds of new features and enhancements designed to help people work smarter, reclaim time, and collaborate seamlessly”

Microsoft also points out that this upcoming price increase will be the first uplift to Microsoft’s CRM and ERP product pricing in more than 5 years.

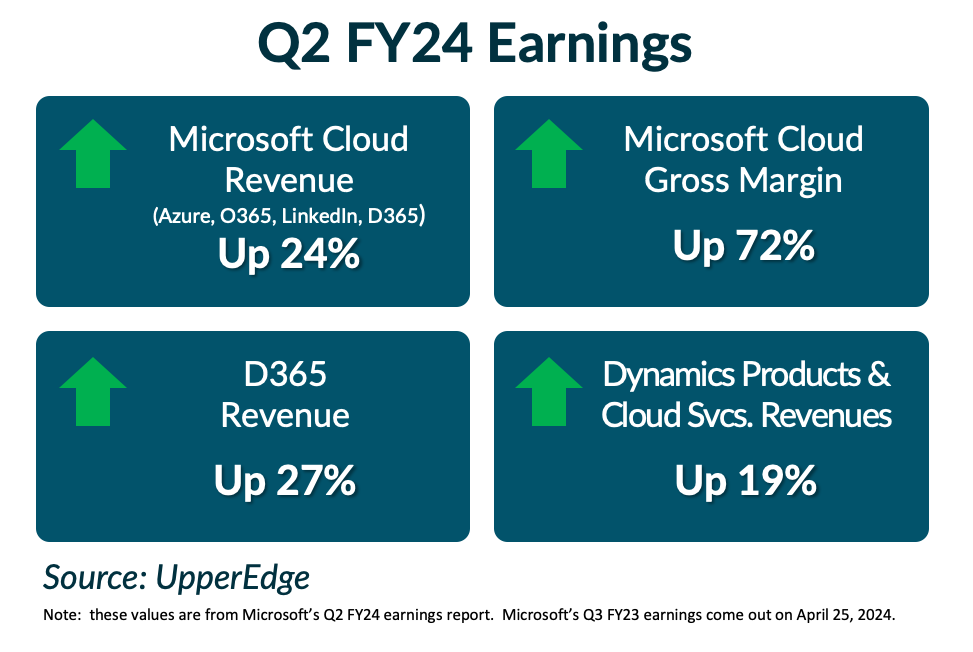

Outside of value add, we know that for Microsoft, it always comes down to also finding ways to increase their revenue stream, specifically their Cloud Revenue. One way to do that is to simply increase the often talked about ARPU, something all cloud vendors are focused on. If the underlying list price goes up for Dynamics 365, that’s a fast way to increase the ARPU tied to their entire base of customers using these products.

Note: these values are from Microsoft’s Q2 FY24 earnings report. Microsoft’s Q3 FY23 earnings come out on April 25, 2024.

What will Microsoft Account Executives Push Between Now and October?

Microsoft is also ultimately trying to get more customers to adopt Dynamics 365. If you announce a price increase to D365 several months ahead of their effect, it certainly helps “motivate” (or perhaps force) customers to adopt the product before the uplifts take effect. That is Microsoft’s game plan at least.

And that is exactly what you can expect from your Microsoft account executive if you do not already have D365 and are currently evaluating the offerings against the competition. You can also expect Microsoft account executives to push for early renewals that come with extended term and downstream revenue commitments. By doing this Microsoft not only locks in downstream committed revenue, it also creates longer and stronger vendor-lock in.

You don’t have to look any further than Microsoft’s most recent Q2 FY24 earnings call, where they have made it clear that pushing Dynamics 365 adoption is important to them because it is tied into their Microsoft Cloud Revenue.

During the earnings call, Microsoft’s CFO, Amy Hood, mentioned that “Dynamics 365 bookings growth was impacted by weaker new business, primarily in Dynamics 365 ERP and CRM.” This is something that Microsoft needs to correct. As such, Microsoft is aggressively trying to get market share for their Dynamics 365 products and beat out competitors like Salesforce (CRM), SAP (ERP) and Oracle (ERP).

You can also fully expect the greatest amount of push to be towards getting deals done by Microsoft’s year end in June. Microsoft would love to announce improvement to their Dynamics 365 CRM and ERP adoption close rate and revenue growth. They would love to be able to name a few key “wins” as well. For those customers that can allow for public statements like that, that will carry significant leverage too.

How Can Microsoft Customers Combat Dynamics 365 Price Increases?

There are a few things that your organization can do to prepare for your net-new D365 negotiation or upcoming renewal with these price increases in mind. First, hopefully you have renewal term price protections in place that adequately address the level of increase Microsoft can apply at your upcoming renewal for D365. If you do, and your renewal is after October 2024, you may be in a good position to tackle these price increases. Additionally, if you are a net new customer, it is more critical than ever for you to get price caps to protect against increases at your initial renewal and ensure these increases don’t impact you downstream.

Unfortunately, many customers do not have renewal term price protections in place and will have to deal with the list price of D365 increasing on top of the normal increases these customers are hit with. Even further, for customers that have a renewal after October 2024, you may be hit for the first time by both the D365 price increases and the Microsoft 365 and Office 365 price increases that took effect in March 2022. If you are in either of these situations, you need to ensure you approach your upcoming renewals with as much leverage as possible to ensure you reach competitive pricing for your portfolio.

One way these customers (and all customers) can arm themselves with leverage is to set aside time to carefully assess their current utilization of products as well as the actual value received to date. As part of this, customers need to look closely at the expected go-forward value as well. In other words, if something at the feature level has not been used to date, are there plans to use it in the near future? What is your roadmap?

Microsoft wants to talk about all the added or “extra” value and features to justify these increases, but the fact is if the added features are not actually being used and will not be used moving forward, then a case can certainly be made that this “extra” value does not warrant the price increase for you specifically. Or perhaps you are using the “extra” value, but there are other features not being used and will not be used moving forward. In either situation, you can increase leverage and should add this to your story with Microsoft.

More often than not, customers are not utilizing the full scope of features and enhancements available to them in their products. Customers need a granular-level knowledge of their use, especially in these cases where value is not being realized, as it will help shape and drive the negotiation with Microsoft. Also, by showing Microsoft what has not been utilized, you can push for them to step up and provide investments to ensure your company does get the expected value through use moving forward.

Also, let Microsoft know that how they decide to treat you with regard to these price uplifts will have an impact not only on the perception of Microsoft within your organization, but also on your willingness to adopt something new. For those customers that Microsoft is trying to push Copilot for M365 adoption onto, they could benefit from telling Microsoft that if they want that adoption, they can’t try to squeeze more money out of you by hitting you with programmatic price uplifts to your D365 products. It is already going to be hard enough to come up with the $30/u/m for Copilot for Microsoft 365, so forcing customers to find more money to cover unexpected (and unjustified) price uplifts will kill the conversation.

Lastly, for those Dynamics 365 customers that have renewals coming up ahead of October 1st and thus will not feel the impact of these list price increases, it will be critical to push hard for renewal term price protections. Also, even though Microsoft won’t be able to impose the list price increase covered, they will likely still impose an increase through the removal of any additional discounting you may have achieved previously. If the proper plan is in place, these increases can be overcome.

At UpperEdge, we help customers overcome imposed price increases and secure the proper upfront pricing as well as renewal price protections to ensure they receive competitive pricing at all phases of their contract. Explore our Microsoft Advisory Services to see how we can help.

Related Blogs

What Microsoft Customers Want From Microsoft in 2026: Stop Pushing and Start Proving Value

Microsoft Increases M365 Pricing Again! What Customers Need to Know

SaaS Price Increases: What If Vendors Only Charged More When You Got More?

About the Author