- Adam Mansfield

- Reading Time: 5 minutes

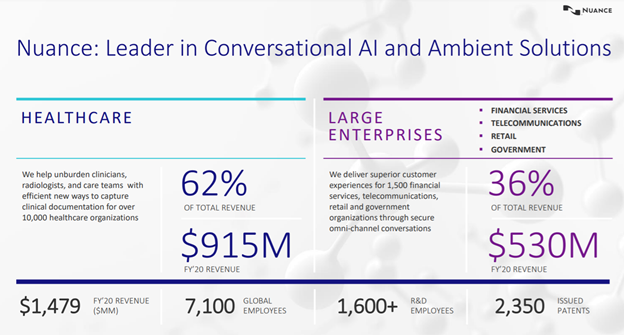

On April 12th, Microsoft announced the $19.7B acquisition of Nuance Communications, a provider of artificial intelligence (AI) and speech recognition software. This is the second largest acquisition Microsoft has ever made, surpassed only by their $26B acquisition of LinkedIn back in 2016. As AI continues to be a clear priority for the tech giants, this acquisition will help Microsoft better compete with major cloud leaders such as Amazon Web Services (AWS) and Google Cloud.

This is big news not just because of the sheer size of the acquisition but because of what it means for Microsoft and how it will further advance its industry-specific focus and the related sales strategy to push current customers to increase adoption of a wide range of its products.

The Focus Is on Healthcare (For Now)

One of the most important aspects of this acquisition is how it will advance Microsoft’s presence in the healthcare industry. Nuance has largely focused on healthcare in recent years and 77% of US hospitals already use Nuance. In 2020, 62% of Nuance’s total revenue came from healthcare.

Image Source: ZDNet.com

Healthcare is one of the largest and fastest-growing industries in the world and global healthcare spending has been forecasted to reach $10 trillion by 2022. The healthcare vertical represents a huge opportunity for Microsoft especially as more healthcare providers accelerate their digital transformations to meet the increased demand for telehealth services and to combat higher rates of burnout, something that AI technology can help alleviate.

Understandably, much of the immediate publicity and coverage around the news of the acquisition was centered on Microsoft’s clear focus on the healthcare industry. The announcement stated that the acquisition “will double Microsoft’s total addressable market (TAM) in the healthcare provider space, bringing the company’s TAM in healthcare to nearly $500 billion”.

Microsoft Cloud for Healthcare

Nuance’s penetration in healthcare is very appealing to Microsoft given the extended access that comes with it and the proven Nuance technology that healthcare providers are already using, which can add new capabilities to Microsoft’s industry-specific solutions, starting with healthcare.

In October 2020, Microsoft announced Microsoft Cloud for Healthcare, an add-on solution starting at $95 per user per month that adds healthcare-specific configurations, customizations, and applications to your Microsoft instance. The subscription also includes benefits such as healthcare templates, workflows, and access to Microsoft’s healthcare partner ecosystem.

It’s important to note that each of the add-on capabilities have specific prerequisites tied to core Microsoft products that Microsoft wants customers to be using, including:

- Microsoft 365: Teams

- Power Platform: Power Apps, Power Automate, Power BI

- Microsoft Dynamics 365: Marketing, Customer Service, Digital Messaging Add-on, Field Service Resource Scheduling Add-on

- Microsoft Azure

For example, to enhance patient engagement with the “virtual health” capability, you must have Microsoft Teams which is a part of Microsoft 365. To unlock the “clinical analytics” capability, you will require the Power Platform (specifically Power Apps, Power Automate, and Power BI) along with API for FHIR (a component of Microsoft Azure) to enable interoperability. In addition to prerequisites, many of the capabilities also have “recommended” components of the core products.

While this add-on solution isn’t a traditional software bundle, the subscription could be problematic for customers given the bundle effect. To unlock the full value from your subscription (which is not cheap), you will need the identified prerequisites that span across pretty much all of the core products Microsoft is trying to sell to increase adoption.

Bundling and grouping products through the promise of enhanced value through integration is a common way for tech providers to become more deeply ingrained in your business, ultimately increasing your dependency on them while decreasing your leverage and your ability to walk away.

Microsoft’s Cloud Industry Solutions

Microsoft stated that the Nuance acquisition represents the latest step in its industry-specific cloud strategy. Most of the cloud leaders (AWS, Google Cloud, SAP, Oracle, Salesforce, etc.) have been pivoting to provide industry-specific products in their own way so it’s not surprising that Microsoft began to launch their own industry-specific cloud offerings in late 2020 and announced three more in February of 2021. Any enterprise cloud vendor that has not focused on building (and pitching) industry-based solutions would be the exception.

While announcements of this acquisition focused on Microsoft Cloud for Healthcare, which seems to be the most mature of the industry-specific offerings so far, Microsoft will likely integrate Nuance’s AI technology and capabilities into the other industry solutions. This would further enhance the potential associated value proposition that can be pitched to prospects and customers within the various industries.

I imagine Microsoft’s pitch sounding something like this: “In addition to the unmatched benefits you would receive from adopting Microsoft 365 (preferably E5), Dynamics 365 (as many SKUs as possible), all parts of the Power Platform (Power Apps, Power BI and Power Automate), and of course Azure, we can now also bring you the most advanced and proven AI technology…should I start to pull together the paperwork?”

We expect Microsoft to continue to build out the other Microsoft Cloud industry solutions, as well, especially Microsoft Cloud for Financial Services, Microsoft Cloud for Retail, and Microsoft Cloud for Manufacturing. For manufacturing, in addition to the long list of products and solutions listed above, Microsoft will throw HoloLens into the conversation. For retail, they will certainly mention Microsoft Advertising for Retail.

Ultimately, the ability to insert Nuance and its AI technology into the conversations is going to help promote the strength of these overarching industry-based offerings and help them pitch companies to move in that direction by adopting more of the Microsoft products that make up the holistic integrated solution. Whether there is or will be true integration is a topic for another day.

What Customers Should Keep in Mind

As cloud leaders and big tech vendors continue to buy up other technology companies like Nuance in an effort to better compete with each other, the subscription fees that customers are paying these vendors are helping fund these massive investments. While that is somewhat expected, customers still want to see (and should expect to see) direct value come from these investments.

But like any acquisition, it takes time to integrate the solution into the other products in the portfolio and for customers to ultimately reap the benefits of the acquired capabilities. Current Microsoft customers, especially those that are already being pitched or will eventually be pitched a particular industry solution, should be asking:

- How long will it take for that functionality to be usable and ultimately valuable?

- What if it’s not valuable for my company specifically?

- What happens if the expected value that you pitched is not ultimately realized?

If you’re a Microsoft customer that is considering any of the industry-specific solutions, you should know that once you start going down that path, there’s really no turning back. You will be forever tied to Microsoft. That’s all the more reason why you need to challenge Microsoft to explain the value of each piece of the solution in addition to the collective value, and to make sure you negotiate key commercial items to protect your business down the road.

Beyond making sure you have the right price, you need to ensure you obtain the right level of pricing transparency, price protections, flexibility, etc. If you are able to obtain these things, it may not be all that bad to be forever tied to Microsoft, especially if any expected value is being realized and the value actually goes up over time.

What to Read Next:

Related Blogs

What Microsoft Customers Want From Microsoft in 2026: Stop Pushing and Start Proving Value

Microsoft Increases M365 Pricing Again! What Customers Need to Know

SaaS Price Increases: What If Vendors Only Charged More When You Got More?

About the Author