- Adam Mansfield

- Reading Time: 6 minutes

Salesforce’s full year FY21 results showed that Salesforce blew past its $20B target. They also raised FY22 revenue guidance (to between $25.65B – $25.75B) and forecasted they expect to generate $50 billion in annual revenue by fiscal 2026.

Double-digit revenue growth and a constant upward trend of success has become the norm for Salesforce. The SaaS cloud subscription model is built to increasingly raise customers’ costs and dependency over time, but Salesforce has taken this to the next level with their incredibly effective sales and marketing tactics. In many ways, they have become the model for other cloud vendors. For quite some time, Salesforce has had a wide and loyal customer base that continues to adopt more products (built and acquired) with no real signs of slowing down.

Building Out the Sales Machine

Salesforce is clearly focused on investing heavily in building out its marketing and sales functionality. In just the past couple of years, they have hired or promoted some key executives (see Figure 1) to lead and enhance the way Salesforce markets and sells its products and solutions.

Salesforce’s Sales and Marketing Investments

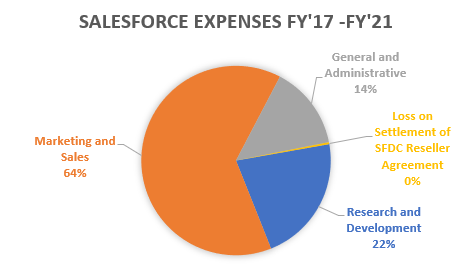

Historically, most of Salesforce’s operating expenses have been related to Sales and Marketing (reported as Marketing and Sales). On average, SaaS companies spend around 40% of their operating costs on Marketing and Sales and roughly 20% on Research and Development. Salesforce’s Marketing and Sales expenses, on the other hand, are well over half of its total operating expenses. As you can see in the chart below (Figure 2), 64% of Salesforce’s total expenses over the past 5 years are attributed to Marketing and Sales.

It is also worth noting that Salesforce has steadily increased the amount it spends on Marketing and Sales over this same 5-year period (see Figure 3 below) and their recent earnings call suggests they will be spending even more on sales moving forward.

During its Q4 FY21 earnings call, an analyst asked about Salesforce’s current pipeline and whether they are properly staffed to capture the opportunity coming out of the recession. Chief Revenue Officer, Gavin Patterson, responded, “You’d be delighted to hear that we’re investing significantly in terms of our direct sales force to take advantage of that demand.” He went on to say, “I think you’re hearing today a message from us all that the business is strong, the pipeline is strong, and we’ve got confidence going into the year.”

This is exactly the kind of statement investors want to hear but what does it mean for current Salesforce customers? As a customer, are you “delighted” to hear that Salesforce is investing significantly in its sales force to better arm themselves to sell you more and acquire new customers? Are you happy to learn that they are planning to spend even more moving forward?

Part of the reason customers pay for subscription cloud services is to receive updates and see innovations and improvements in return for the subscription fees paid. Remember, you don’t actually own anything when it comes to the cloud, so you rely heavily on these improvements. It is not like you can easily take your ball and go home if you feel you are not getting what you paid for and Salesforce knows this.

Even though Salesforce seems to put more money towards Sales and Marketing than others in the industry and have steadily increased their level of spending, it doesn’t mean that Salesforce is not also investing in innovation and product development. We are not making a comment on the value customers receive from Salesforce’s products or whether Salesforce is focused on ensuring this is a priority.

To be as successful as Salesforce has been, it does not just come down to whether they have a large, highly skilled, and well-funded sales and marketing team. Of course, public companies like Salesforce are going to continuously strive to increase revenue and profits and will leverage their sales and marketing teams to ensure this happens.

However, if you are a customer that has not received the expected value from your Salesforce subscription fees (which may be higher than you should be paying), providing your Salesforce account executive the breakout of Salesforce’s expenses could be helpful during your renewal negotiations. How you present it and what you do during your negotiation is also critical.

Acquisitions Expand Growth for Salesforce

When thinking about where your Salesforce subscription fees go, you can’t forget about the billions of dollars Salesforce has spent on acquiring companies such as Tableau, MuleSoft, ClickSoftware, Vlocity, Demandware and most recently, the $27.7B acquisition of Slack.

Like many large technology vendors, Salesforce acquires companies to expand its portfolio of solutions as well as grow its customer base. For Salesforce, it comes down to making their Customer 360 slide bigger. Investors want to feel confident that these acquisitions and the significant dollars tied to them are going to lead to an ROI. All of Salesforce’s acquisition announcements focus on bringing a level of confidence, often through assurances that there will be an easy transition and integration. The pitch is that current customers will see the power of this integration and ultimately bring the acquired company’s product into their portfolio, which results in spending more money with Salesforce.

The question becomes, are Salesforce customers actually receiving value from these acquisitions? If not, that can be troubling as it is their subscription fees that are helping fund them. This would be another great point to raise with your Salesforce account executive. And if you are interested in adopting Tableau or MuleSoft, it would be good to push for assurances that the easy integration will, in fact, be easy, and the expected benefit will be realized. If not, what will Salesforce do for you?

Regarding Slack, Benioff made it a point during the Q4 FY21 earnings call to mention how Salesforce itself has benefited from using Slack. One of the examples given was how Salesforce used their own Service Cloud along with Slack to improve performance. Benioff also stated that “Once [the] merger is approved, we’re going to build Slack into more of these [Salesforce] products…”

That sounds great, but what if, as a Salesforce customer, you do not intend to use Slack? What if you do not realize a benefit and do not become more productive? For other Salesforce customers, Slack may prove to be an enhancement that drives more value but if it is not for you, that doesn’t really matter.

What Can Salesforce Customers Do?

It’s helpful to pay attention to what Salesforce is spending their money on since these investments, whether it’s buying new companies or putting significant dollars into sales and marketing, comes from your subscription fees.

Again, this is not to suggest that Salesforce’s products and solutions lack value and/or innovation. They are no different from other publicly-traded large technology vendors aiming to grow their revenue and profits. The key here is to ensure that your business is getting the expected value from the Salesforce products you invested in and that your Salesforce account executive stays focused on that rather than simply selling you the next thing.

If you determine you aren’t getting the expected value from the Salesforce products for which you have been paying ongoing subscription fees, the first thing you should do is gain internal alignment among the executives (e.g., line-of-business, IT, C-Suite, etc.) who have interactions with Salesforce that this is the case and that this is going to be placed on Salesforce’s desk to address before any new products will be considered.

If history is any predictor of the future, you can fully expect to see an even more aggressive sales approach taken by Salesforce in the coming months and years as Salesforce pours more of its resources into selling and marketing in order to eclipse the $50B marker they have put out there. It is now more important than ever to make sure you prepare appropriately for these tactics and the approach Salesforce will take.

Related Blogs

Don’t Let Divestitures Undermine Your Salesforce Negotiation

SaaS Price Increases: What If Vendors Only Charged More When You Got More?

Salesforce Increasing Pricing and Adding Agentforce Options: What Customers Need to Know Now

About the Author