- Erik Bullard

- Reading Time: 4 minutes

Salesforce’s new Agentforce offering seems to be a culmination of capabilities from recent Salesforce acquisitions. Here is how the most recent acquisitions have impacted Agentforce and Salesforce’s overall growth strategy.

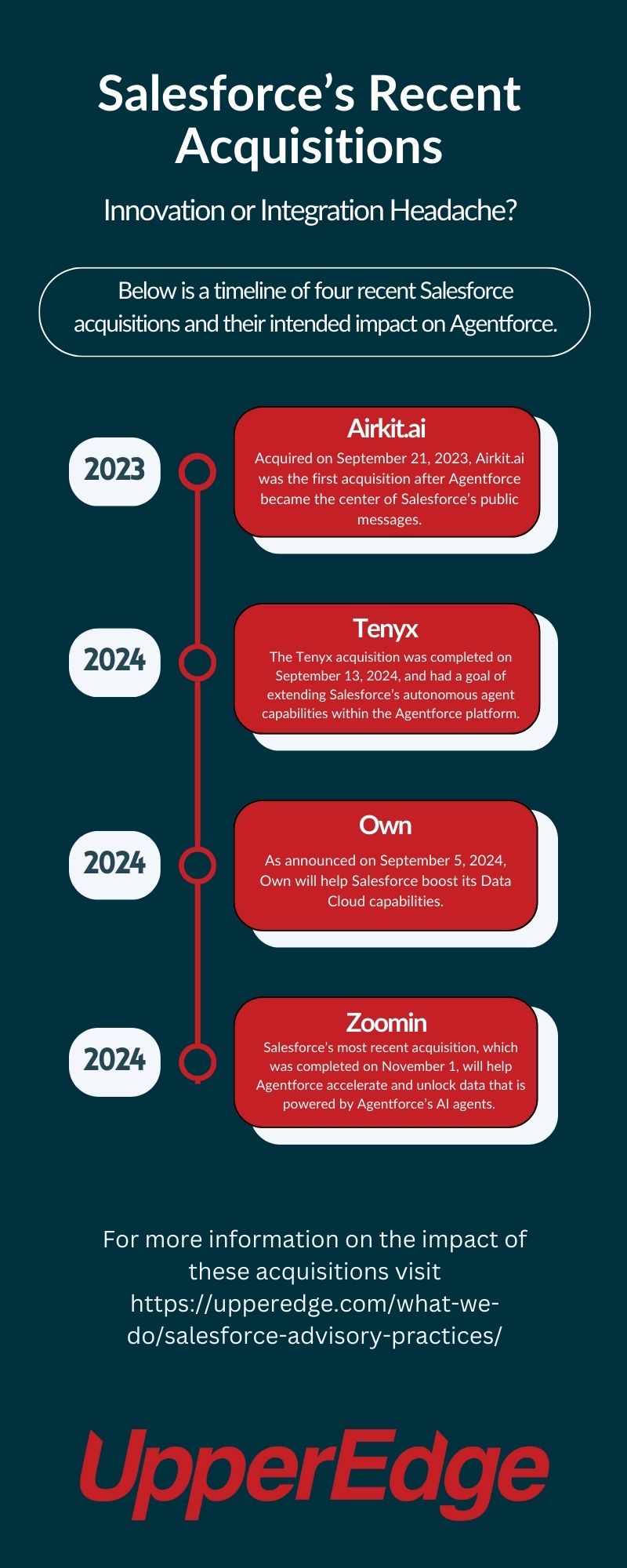

Salesforce continues to make headlines with its aggressive acquisition strategy, recently adding companies such as Airkit.ai, Tenyx, Zoomin, and Own Co. (formerly OwnBackup) to its growing portfolio. These moves illustrate the company’s propensity to buy innovative solutions rather than develop them internally. Even Salesforce CEO Marc Benioff notes that buying will continue to be something they focus on.

Recently, Salesforce has been aggressively pushing its newest AI offering, Agentforce. As anyone who went to Dreamforce knows, Agentforce is impossible to keep out of your Salesforce conversations. Benioff has put some aggressive numbers out there, forecasting how big of an impact Agentforce will make on Salesforce’s revenue and how it will become ingrained in organizations around the world.

Specifically, he said “Agentforce is going to be fundamental to our future and a manifestation of a decade of AI leadership” and that “thousands of customers will be using Agentforce by the beginning of the next fiscal year…By end of FY26 (January 2026), we will have one billion agents.” If you haven’t already adopted the functionality, your organization’s name is certainly on a board somewhere.

Here, I will provide a brief summary of some of Salesforce’s most recent acquisitions and the impact they have had on building out the Agentforce offering and Salesforce’s overall growth strategy.

Summary of Recent Salesforce Acquisitions

Understanding the following four acquisitions and how they have helped bolster the launch and promotion of Agentforce can better inform your negotiation strategy and provide key leverage. Here is how Airkit.ai, Tenyx, and Own and Zoomin have impacted products such as Data Cloud and Agentforce.

Airkit.ai Acquisition

Did Salesforce build Agentforce, or did it start with a company called Airkit.ai? When Airkit.ai was acquired, it was Initially announced to become part of Service Cloud. However, it was quickly framed as “the future of customer engagement… powered by AI-driven customer experiences.” This acquisition was completed at the end of 2023, and it was not too long after that Agentforce became front and center for Salesforce’s public messages.

Tenyx Acquisition

The acquisition of Tenyx is also noteworthy as it stands to extend Salesforce’s existing autonomous agent capabilities within the Agentforce platform. Tenyx specializes in advanced voice AI solutions designed for service-oriented applications, which means Salesforce can enhance customer interactions by enabling more natural, intuitive conversations. The question remains though: What will integration look like, and how will it impact customers?

Own Acquisition

Similarly, the acquisition of Own aligns with Salesforce’s goal of boasting its Data Cloud capabilities. Own focuses on tools for backing up data in cloud-based applications. This is critically important to pay attention to as Salesforce has been aggressively pushing Data Cloud into deals wherever they can.

They have also been tethering other product functionality to the inclusion of Data Cloud. As things become more ingrained, it will become even harder to walk away from any particular Salesforce solution. This “stickiness” will come, even if the value isn’t there. Agentforce is a perfect example of this – a very prominent and new solution that can directly impact costs to other products like Data Cloud.

Zoomin Acquisition

Zoomin is another recently announced acquisition that could impact several offerings. Zoomin’s capabilities are specifically centered around accelerating and unlocking unstructured data and made to be powered AI agents. Salesforce states that with the acquisition of Zoomin “… Agentforce will gain new levels of intelligence, enabling customers to build AI that provides real-time, data-informed responses and actions tailored to individual customer needs.”

The Impact of the Most Recent Salesforce Acquisitions

Salesforce’s strategy of acquiring rather than building has its drawbacks. The company has struggled with integrating past acquisitions like Slack, Tableau and MuleSoft, which were initially touted as game-changers. Customers have often found themselves dealing with fragmented experiences, as the integration processes have proven complex and challenging. This raises concerns about Salesforce’s ability to effectively harmonize its expanding portfolio, potentially leading to unmet expectations for users.

Beyond just the technical impacts, there are commercial considerations as well. Imagine that you have multiple Order Forms tied to each of the solutions that gets added to your tech stack. It is a very common scenario and one that really works towards Salesforce’s advantage.

Need to reduce or right-size? Get ready to be “punished” with price increases and have zero recognition for the large purchase or even product adoption that you may have made just months earlier. Having the proper commercial relationship is critical, and unfortunately, not always straightforward in Salesforce’s ever evolving landscape of products.

The Bottom Line

Ultimately, while Salesforce’s acquisition strategy aims to keep the company at the forefront of innovation, it also highlights a critical issue: the need for robust development and integration efforts. The focus on acquiring shiny new technologies can overshadow the importance of ensuring these solutions work seamlessly together. As a result, many customers find themselves navigating a fragmented ecosystem, where the promise of enhanced capabilities often falls short of reality.

At UpperEdge, we help you evolve your Salesforce negotiation strategy alongside Salesforce’s growth strategy and the continuous Salesforce acquisitions. Explore our Salesforce Advisory Services to see how we can help.

Related Blogs

How Salesforce Can Accelerate Growth in 2026: Start by Easing Up and Listening

Don’t Let Divestitures Undermine Your Salesforce Negotiation

SaaS Price Increases: What If Vendors Only Charged More When You Got More?

About the Author