- Jeff Lazarto

- Reading Time: 6 minutes

An unbiased HRIS comparison of SuccessFactors and Workday that reviews commercial flexibility and overall approach to relationship.

Business leaders who fully recognize the importance of recruiting, developing, and maintaining corporate talent turn to predictive analytics and cloud-based technologies for Human Capital Management (HCM) to get in front of these challenges. There are many cloud-based HCM options available today such as Workday, SAP SuccessFactors, Oracle HCM Cloud, and Ultimate Software.

Today, we will compare two of the leading HCM solutions: Workday and SAP SuccessFactors. While every situation is different, understanding what other companies have experienced with different HRIS providers can help you select the best solution for meeting your company’s unique needs.

After reflecting on many of our Workday vs. SuccessFactors sourcing engagements, we arrived at the following summary of differentiators.

Overall Approach to the Relationship

SAP’s Approach to Relationships

If you are a current SAP customer, your SAP account executive has most likely asked to discuss your SAP relationship and the benefits of integrating SuccessFactors. When it comes to securing demo meetings, the ERP software giant may have an advantage over Workday. Its wider range of product suites and well-established install base gives SAP a bit of a head start in promoting its cloud-based HCM solution.

With that in mind, SAP often cites benefits such as implementation ease and speed, SuccessFactors’s seamless integration with SAP’s other solutions, and the overall enterprise solution accountability that a single provider like SAP can provide. Historically, SAP’s predominantly IT-grounded relationships have leveraged the office of the CIO for the point of entry. However, more recently, SAP has gained traction directly with line of business executives, such as HR to make their case directly to those stakeholders.

If you’re considering SAP SuccessFactors, you should expect an aggressive sales force armed with success stories and references from longstanding SAP customers who have integrated the SuccessFactors solution without a hitch.

Workday’s Approach to Relationships

Although Workday cannot leverage an installed base the size of SAP’s, it gets a lot of coverage as one of Wall Street’s darling growth stories. It receives the attention of Chief HROs who read the Workday buzz and hear from peers who love the product and the vision.

Workday leverages its market coverage and spends its time and energy on securing time with the HR executive. From our perspective, Workday has been quite focused on selling first to the business and then using those interactions to obtain a broader audience with IT and other members of the evaluation team to gain their buy-in.

You should expect Workday to highlight the benefits of their homegrown solution and to emphasize that it was developed from the ground up. Particularly, within an organization co-founded and led by Dave Duffield and Aneel Bhusri, who have been developing HR solutions since their days running Peoplesoft.

It is this foundation of leadership in the HR technology space that motivates Workday to fill its proposals with call outs to innovation excellence and building solutions tailored for the HR organization based on years of listening to and aggregating key requirements of the HR end user. Workday sees this as a core differentiator and therefore spends a considerable amount of time pointing out how SAP did not build their solution from scratch but rather acquired it from SuccessFactors.

Approach to the relationship when selection is led by Business: Edge goes to Workday

Approach to the relationship when selection is led by IT: Edge goes to SuccessFactors

HCM Solution Capabilities and Packaging

UpperEdge is not a market research firm so we do not conduct research and publish reports assessing and comparing vendor solution offerings. However, we regularly assist companies who are sourcing solutions such as Workday HRIS and SuccessFactors.

As a result of advising on numerous transactions in this space, we aggregated the results of how our clients respectively assessed Workday and SuccessFactors to arrive at some consistent scoring themes. For core HR, payroll and benefits, the majority of our clients have rated Workday on top. For functionality such as recruiting, succession planning, compensation, learning and performance management, the majority of our clients assessed SAP’s SuccessFactors solution as better.

In addition to solution capabilities, you should also understand and assess how Workday and SuccessFactors respectively package their functionality as part of the annual subscription. For example, Workday’s “Workday HCM” solution is a bundled offering that includes key functionality such as compensation, goal management, performance management and succession planning (among others). Workday forces you to subscribe to the entire bundle upfront and will not permit you to break the bundle apart.

With SAP, you can subscribe to an equivalent level of functionality (i.e., compensation, performance management, goal management and career development planning (CDP)) on an individual, product level basis. SAP will often let you subscribe to the functionality on a component basis and in a manner that aligns with the timing of when you actually need the functionality.

However, flexibility can come at the expense of other commercial considerations such as cost. SAP typically does not offer this component model out of the gates. But if positioned appropriately, they will present it as an option since this level of transparency will be important to ensuring you have the predictability on cost and value over time.

Recruiting, succession, compensation, learning and performance management solution: Edge goes to SuccessFactors

Core HR, payroll, and benefits solution: Edge goes to Workday

Solution packaging flexibility: Edge goes to SuccessFactors

Overall Commercial Flexibility

It is critical to achieve highly competitive initial subscription pricing along with long term price protections and flexibility. You must also put a meaningful service level structure into place that holds the providers accountable for the performance of the solution. As you may expect, Workday and SuccessFactors approach these areas differently.

From an overall subscription fee perspective, SAP’s SuccessFactors solution is typically lower. If you support your strategic negotiation with relevant market intelligence that includes specific SAP SuccessFactors benchmarks, SAP will provide deep discounting to win your business.

Workday, on the other hand, is quite comfortable telling you they do not deeply discount and acknowledge that the SuccessFactors solution will be cheaper. Workday will inform you that they treat all organizations the same (regardless of the size), maintain integrity of pricing, and will not deeply discount to win business as they feel the value of their solution is far superior to SuccessFactors.

Even though Workday acknowledges that a SuccessFactors subscription will be less expensive, they counteract this by presenting numerous reports and findings that show the cost and time to implement the Workday solution is much lower and shorter. At this point in time, the numerous Workday and SuccessFactors system implementation estimates maintained within our intelligence database support Workday’s position.

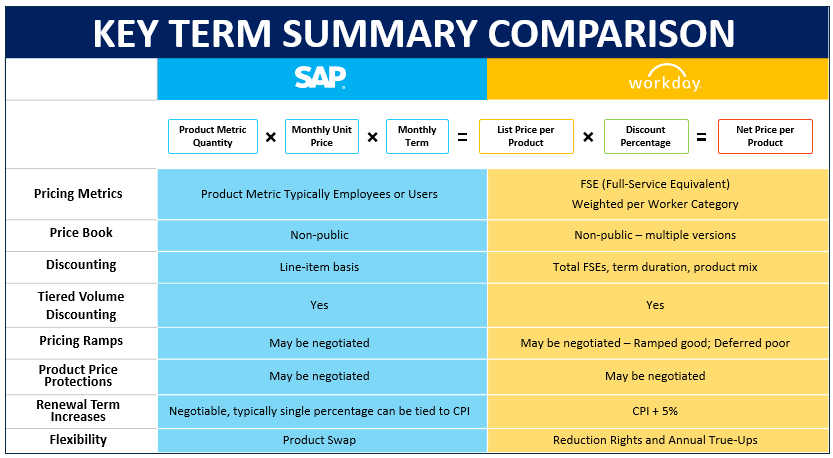

In addition to more compelling upfront pricing, SuccessFactors has been more willing to put long term price protections in place that minimize the opportunity for cost increases during subsequent renewal terms. Workday has also shown a willingness to put price protections in place, however, achieving these protections typically requires significant back and forth effort with the results often not as good as those achieved with SAP. The following table shows how both SAP and Workday calculate their net price per product and compares the providers based on several other key terms.

For service levels, Workday digs its heels in and simply tells you they do not negotiate or modify their service levels or service level credit structure. Workday will bring you back to the fact that they believe in treating all organizations equally and therefore do not make client specific modifications to the service levels or the service level credit structure.

On the other hand, SAP will show a willingness to negotiate and improve their standard service level credit structure both in terms of credit percentage and ability to terminate for service level non-conformance.

Overall commercial flexibility: Edge goes to SuccessFactors

Given the enterprise application industry’s focus on the cloud, it is a bit of a land grab for the solution providers. Seeding the market is paramount to profits right now, so it is a great time to be evaluating competing solutions within the market.

Both providers are hungry to win your business and if you know what to ask for, you can ensure your company will be set up properly for the long haul. Savvy buyers armed with precise market intelligence can run highly effective processes for securing these solutions, which is critically important given the high renewal rates in this space.

Related Blogs

Hyperscaler Renewals: Strategic Takeaways for CIOs and Infrastructure Leaders

Workday’s Latest AI Announcements: What You Need to Know Before Entering the Negotiation Room

Decoding SAP Sapphire 2025: What’s New, What’s Next, and What’s Unresolved

About the Author