- Adam Mansfield

- Reading Time: 7 minutes

ServiceNow CEO, Bill McDermott, recently stated, “We want to be the most innovative, the fastest-moving, most resilient enterprise performer for our customers on the planet.” This sounds ambitious but it’s not that unrealistic for a company that was already named the #1 most innovative company by Forbes in 2018.

Innovating Through Acquisitions

ServiceNow announced in November 2020 that it would acquire Canadian startup Element AI and closed the deal earlier this year for approximately $230M. Through this acquisition, ServiceNow gained technical talent and expanded its AI capabilities. But the question becomes, will this accelerate AI innovation on the Now platform?

Perhaps more importantly, will ServiceNow’s customers actually realize the intended benefit that was so heavily pitched? I know that ServiceNow has a strong record of producing products that customers value, but customers expect (as they should) innovation to drive the expected value. The idea of innovation is just not enough.

It is clear that one of the reasons ServiceNow is making acquisitions like Element AI, is to further bolster their solutions to make them more valuable and even more “sticky.” This is clearly the goal when it comes to getting more customers to adopt and/or move to IT Service Management (ITSM) Pro. By ServiceNow’s own admission, there are now only 20% of customers that have adopted ITSM Pro.

In their recent Q4 2020 earnings call, CEO, Bill McDermott stated:

“The AI/ML capabilities of our Pro SKUs are automating processes to allow people to focus on the work that really matters. We saw a three-time increase in usage of our virtual agent technology in 2020. And our Element AI acquisition underscores our commitment to being the leader in AI-enabled workflows. Element AI’s deep bench of world-class scientists and practitioners will accelerate our AI innovation on the Now Platform, delivering not only better capabilities for it, but for employee and customer experiences as well.”

The significant acquisition of Element AI comes after multiple other AI and automation acquisitions that ServiceNow made in 2020 under Bill McDermott’s leadership. Others include Sweagle (for $25M), Passage AI ($33M), and Loom Systems ($58M).

ServiceNow also just announced that they are acquiring India-based RPA (Robotic Process Automation) startup, Intellibot. In the press release, Josh Kahn, SVP of Creator Workflow Products at ServiceNow, mentioned:

“With Intellibot, we will extend ServiceNow’s ability to help customers connect systems so they can easily automate workflows and drive productivity.”

While it’s great to see technology companies like ServiceNow making a commitment to innovation, in this case, through acquiring AI, machine learning and RPA companies, remember that customers don’t instantly get a benefit from these. It takes time to fully integrate the companies and their capabilities into the platform and even when the integration is complete, the customer has to actually realize the intended benefits (or even have an ability to realize them).

Operational Investments in Innovation

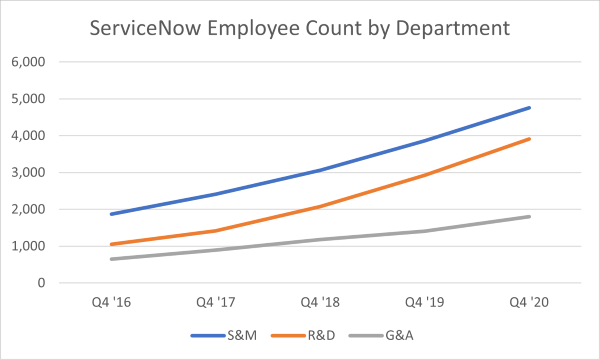

In addition to acquiring companies to enhance their Now platform and produce releases filled with new features (like the recent Quebec Release), ServiceNow also spends much of their internal resources on innovation. Over the past 5 years, ServiceNow has steadily increased the number of Research and Development (R&D) employees it has in addition to increasing its Sales and Marketing employee count (Figure 1).

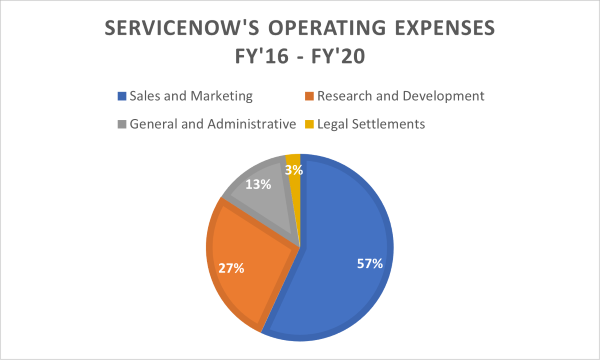

While SaaS companies generally spend an average of around 20% of their operating costs on R&D, ServiceNow has spent an average of 27% over the past five years (see Figure 2).

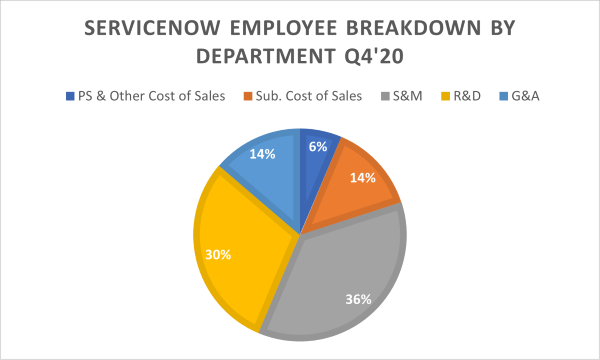

Also, in Q4 2020, ServiceNow’s R&D department made up 30% of ServiceNow’s employee base (see Figure 3).

ServiceNow’s investments in technical talent seem to be paying off or at least leading to more innovation released. McDermott recently said:

“The level of innovation they’re (the ServiceNow engineering team) pushing out, is a 70% increase in 2020 over 2019 and we have major releases coming this year commensurate with what we did last year.”

Again though, it is one thing to push out innovation as McDermott made a point to mention, but it is another for that innovation to be of value to ServiceNow’s customers. This is not to say that it is not currently valuable or that it won’t eventually lead to value for customers, but it is important to always bring things back to actual value received. There are many CIOs, CDOs, etc. who would love to have the luxury to only be held accountable to achieving the promise of innovation or digital transformation.

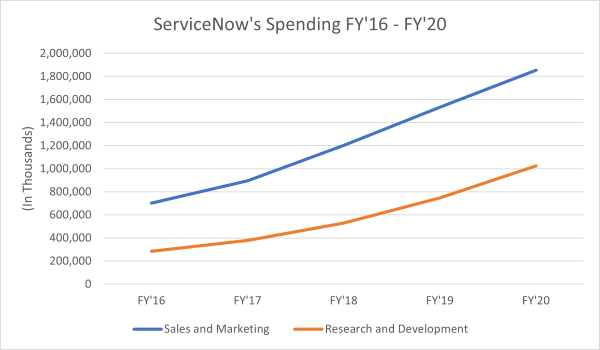

There is no denying that ServiceNow is a growing company that genuinely focuses on innovation and R&D, but like Salesforce and many other SaaS companies, ServiceNow’s largest operating cost is still Sales and Marketing. You’ll also see that ServiceNow has increased the amount they spend on Sales and Marketing at a faster rate than what they spend on R&D (see Figure 4). There is nothing wrong with that, per se, but it is important to always remember that this is the case.

Most of the large SaaS companies are publicly traded and they are logically focused on making money and bringing a return to their investors. On average, SaaS companies spend 40% of their operating expenses on Sales and Marketing, but ServiceNow has spent significantly more, spending an average of 57% between 2016 and 2020 (previously shown in Figure 2).

Of course, it is worth pointing out that even though they have spent more of their money on Sales and Marketing than most, they still haven’t spent as much as SaaS leader, Salesforce. 64% of Salesforce’s total operating expenses over the past 5 years are attributed to Marketing and Sales.

The reason it is important to pay attention to things like this is that SaaS customers, in general, need to ensure their dollars are being well spent. The subscription fees tied to these cloud solutions are significant and go up over time rather than go down (that is a topic for another day). For most customers, “well spent” means they are not only getting the expected benefit from the product or solution, but they are also realizing ongoing and continued enhancements (i.e., innovation) that bring additional benefit and value over the subscription term.

When customers don’t feel they are receiving the amount of expected value from a particular SaaS solution, they inevitably (and rightfully) start to wonder if they would realize more value if only the cloud vendor shifted some of the money away from Sales and Marketing and put it towards R&D.

How Customers Can Benefit

As CEO, McDermott must remain focused on driving innovation, but ultimately, he is also focused on driving revenue and continuing to grow the company. Through his work and the work of those before him, he is able to make statements that ServiceNow (currently a ~$4.3B company) has, “A clear path to achieve our $10 billion revenue target.”

ServiceNow will need this type of aggressive revenue growth and the accompanying accelerated product adoption that drives it, to be considered one of the top SaaS providers among the likes of Salesforce, Workday, etc. To get there, they will need to continue to spend a lot on Sales and Marketing while also maintaining a focus on innovation — whether that be through making the right acquisitions or by bringing in the right talent.

The key for ServiceNow is that customers will continue to expect that the investments made with their dollars (i.e., subscription fees) are the right investments. They want to ensure they are investments that drive relevant and valuable features to the solutions they have adopted or are considering. ServiceNow has acknowledged that only 20% of current customers use ITSM Pro, the most robust version of their core product.

This means that 80% of their customers, when given the option, have made the decision not to invest more of their money in ServiceNow’s ITSM Pro, the more costly option. This is not to say that this is directly tied to the added features having little value, but it is pretty telling. Based on these investments, McDermott and ServiceNow clearly see a gap that needs to be filled.

So, do ServiceNow customers really benefit from ServiceNow’s focus and spending on innovation? The answer is, it depends on whether it is relevant to the particular customer and whether the intended benefit from the innovation can, in fact, be realized.

The better question, though, is if a customer is not benefiting to the degree expected, what can the customer do about it? The answer is, let ServiceNow know (or any SaaS vendor this applies to). As granularly as you can, point out the amount of expected value not received (i.e., products not rolled out or features not being utilized). Show them the amount of subscription fees you have made while not receiving the expected value.

Present this information well in advance of any renewal negotiations. Present this information in response to the ServiceNow account executive asking for a meeting to discuss the potential to adopt a new product that is not yet in your portfolio. And when it does come time to negotiate your renewal, present this information when they hit you with an increase in your subscription fees.

Comment below, follow me Adam Mansfield on Twitter @Adam_Mansfield_, follow me on LinkedIn, find my other UpperEdge blogs and follow UpperEdge on Twitter and LinkedIn. Learn more about our ServiceNow Commercial Advisory Services.

What to Read Next:

Related Blogs

What ServiceNow Customers Can Expect in 2026: A Push for More

ServiceNow Impact: The Hidden Costs No One Is Talking About and How to Negotiate Them Down

How Your Cloud Commitment Can Impact Your Next ServiceNow Negotiation

About the Author