- Jeff Lazarto

- Reading Time: 4 minutes

Ever wonder if you should actually start paying as soon as the ink is dried on your Workday agreement? One of the issues that arises in Workday negotiations involves paying the full annual subscription fees while implementing the solution. Customers feel that since the solution is not in productive use and delivering any business value yet, they should not have to pay the full subscription fee amount until after go-live. Considering the standard initial subscription terms are three-to-five years and the average implementation takes one year, that equates to a sizeable portion of fees paid before go-live.

Workday has often resisted offering payment ramps in the past, but that appears to be changing. However, there is a twist that Workday has deployed that customers might not catch which undermines the benefit of the payment ramp.

Workday’s Schedules – Payment vs. Subscription Fee

Generally speaking, Workday uses a standard schedule that evenly distributes the annual fees over the duration of the term, with the same payment amount and subscription fee amount.

However, when a customer requests a payment ramp to offset the reduced value before go-live during the implementation period, Workday separates the payment schedule and the subscription fee schedule. In addition to the separation, they will apply a different formula for developing each schedule.

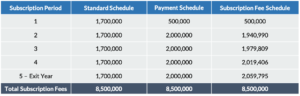

To illustrate, let’s look at an example. Assume that the total subscription fees of $8.5M over 5 years is a very competitive deal based on the modules in-scope and total FSE count. But the customer is requesting to pay less in year 1 until they reach their go-live and the solution is in full productive use. In this example, Workday is offering to reduce the year 1 fees from $1.7M to $500K, for a total reduction of $1.2M. This sounds wonderful to the customer and they accept the offer, but the devil is in the details when they receive the Order Form.

We have inserted what the standard schedule would look like for comparative purposes, but Workday’s Order Form will only include the payment schedule and the subscription fee schedule. As you can see, all three schedules total $8.5M over 5 years, but the annual fees are different.

Payment Schedule Formula

Workday will reduce the year 1 fees by $1.2M, but then spread that $1.2M evenly over the remaining four years. This results in the annual fee increasing to $2M in years 2-5. So, while there is payment relief in year 1, the customer is still paying the full $8.5M over the term and is not receiving a true payment ramp to offset the limited value received in the first year. The twist here is that the payment ramp provides no overall cost reduction.

Subscription Fee Schedule Formula

Workday has what they call an innovation index, which is a percentage increase on annual fees that is marketed as going towards funding the continuous innovation resulting in quarterly enhancements across their cloud solution service offerings. This innovation index is something a customer sees after the initial term, when the renewal term kicks in with price increases. In reality, the innovation index is built into the overall pricing for the initial term, but it is smoothed evenly so that the customer feels they are receiving a flat annual fee each year of the initial term. Therefore, the customer is under the illusion that there are no subscription fee increases for the initial term which greatly aides during the sales cycle.

Here is where the second twist come into play. To offset the cost of recouping the first-year fee reduction of $1.2M over the 5-year term, Workday will take the remaining $8M owed over the next four years, and back into a subscription fee schedule that includes annual increases of 2% to account for the innovation index. In the example, you will see that the subscription fees in years 2-5 increase by 2% annually, while the total subscription fees for the 5-year term are still $8.5M. So why does this matter?

Exit Year and Renewal Term Pricing

Workday’s standard Order Form specifies that the renewal term pricing will be determined by taking the subscription fee for the exit year of the initial term, and then applying the renewal term price increase. This increase can be negotiated as part of your initial deal and includes an innovation index fee percentage and an annual CPI index increase percentage. But the twist here is that the base price for determining your renewal price is the exit year.

Looking at the schedules, you will see that the exit year pricing in the standard schedule is $1.7M, in the payment schedule it is $2M, but in the subscription fee schedule it is just under $2.06M. This means that in year 6, the base subscription fee is already $360k greater than what it would have been under the standard schedule plus you would still need to apply the renewal term increase to the $2.06M on top of that. Let’s say the renewal term increase is 3%. That would translate to an additional $10,800 compared to applying the increase to the standard schedule. This fee discrepancy will only grow wider in the outer years.

The Optimal Schedule

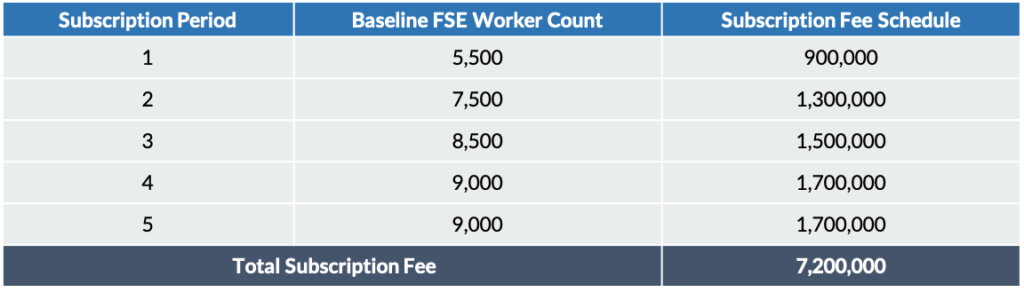

The optimal schedule uses the standard schedule as the starting point and then factors in a ramp by lowering the FSE worker counts with a corresponding reduction to the subscription fees. As illustrated in the table below, you can see the ramped adjustments on an annual basis, with the total subscription fee reduced to $7.2M. This model maintains the integrity of the negotiated pricing throughout the entire term while offsetting the time to implement with annual adjustments.

Holistic View of Workday Pricing

When negotiating your pricing and payment ramps, keep in mind the potential impact to your subscription fee schedule, payment fee schedule, and renewal term pricing. If Workday offers what looks like a great payment schedule ramp, be sure to review all the details to determine if it’s truly a price reduction or just a payment deferral. Additionally, consider the exit year fees and the long-term TCO impact.

Post a comment below, follow me on Twitter @jeffrey_lazarto, find my other UpperEdge blogs, and follow UpperEdge on Twitter and LinkedIn. Learn more about our Workday Commercial Advisory Services.

Related Blogs

From Flat Fees to Growth-Based Pricing: The New Reality of Workday Success Plans

From Announcements to Acquisitions: How Workday’s AI Strategy Should Shape Your Negotiation Approach

Workday’s Latest AI Announcements: What You Need to Know Before Entering the Negotiation Room

About the Author