- Jeff Lazarto

- Reading Time: 5 minutes

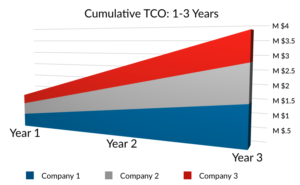

Workday customers lose a significant amount of leverage after their first Workday negotiation and will never be able to “price correct” in future negotiations, so it’s imperative to get it right the first time to avoid paying more for Workday. To shed some light on how that loss plays out from a pricing perspective, we looked at three different similarly sized deals and normalized them as if they had purchased the exact same cloud services and quantities with the same list pricing.

We then applied the actual Workday pricing terms achieved from each of the three deals to illustrate the disparity in total cost of ownership, aka Workday TCO, over a 12-year period. This is based on an initial term duration of three years and includes three renewal terms.

For purposes of this illustration, it is worth pointing out the following:

- Company 1 – Negotiated alone without any third-party support or advice

- Company 2 – Brought in third-party support after initial negotiations

- Company 3 – Utilized third-party support from the outset, prior to and throughout negotiations

All three companies started the negotiation processes with very similar leverage, as these were all first time Workday deals. While having strong leverage is important, what matters more is knowing how to appropriately use that leverage to establish a strong executive-level relationship and negotiate a highly competitive commercial construct that enables long-term success and helps you avoid paying more for Workday over time.

Initial Term Workday Subscription Fees

As you can see in the chart below, Company 1 achieved the poorest discount of the three and paid the most in Workday fees overall. In Year 1, the difference between Company 1 and Company 2 is just under $150K, which would appear to most as a negligible difference. Company 2 already had positioned some initial pricing and commercial terms; when they brought in third-party advisory support, they had already given up considerable leverage as it relates to the initial discounting.

A word of caution – once pricing has been proposed by a vendor and deemed relatively acceptable by the customer, it can be extremely difficult to achieve any further pricing concessions, which is what happened here.

Company 3, however, paid just under $400K less in Year 1 than Company 1, and just under $250K less than Company 2. Many organizations would deem this savings considerable relative to the fact that Company 1 paid just under $1.25M in Year 1. That’s well over a 30% price differential.

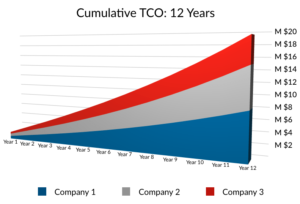

Workday Renewal Term Subscription Fees

Now let’s turn our attention to the outer years and the renewal term price protections that were negotiated. You can clearly see the gap widening between the three companies as the cumulative total Workday subscription cost grows over time. In Year 4 the first renewal term kicks in, and in Years 4–6 you can see the gap widening at an increasing rate. This rate increase is a direct result of the competitiveness of the renewal term price protections.

Company 1 achieved Workday’s standard terms, whereas Company 2 achieved slightly better renewal term price protections, and Company 3 achieved the best protections. Company 2 was able to leverage third-party advisory support, and while the initial price in year 1 remained relatively flat, they were able to improve the renewal term pricing as Workday was a bit more willing to offer more competitive terms to close the deal.

Please note that there are additional renewal term inflection points in Years 7 and 10, which also include negotiated rate increases that further expand the cumulative total subscription cost growing between the three companies.

But let’s take a look at Company 3. Utilizing third-party advisory support prior to commencing any discussions with Workday, they were able to do a few key things the others could not:

- First, they were able to get a Workday benchmark assessment of what a highly competitive commercial deal would look like and, therefore, establish a target goal for negotiations.

- Second, they were able to develop a detailed Workday negotiation strategy and communication process that was based on prior proven successful negotiations.

- Third, they had the validation, support, and discipline required to withstand the many times Workday said no to a request, and they kept pressing the various commercial terms in accordance with their defined Workday strategy.

This customer had a proven plan and were able to stick to it, even when their initial instincts at times may have been to accept something less.

The results speak for themselves. For the same Workday cloud services and quantities, after 12 years Company 1 will have paid slightly under $20.5M (to fit our graphic, we used a cutoff at $20M). Company 2 will have paid just over $17M and Company 3 slightly below $11.2M.

While going it alone may seem like a good idea, in this scenario, Company 1 will have paid $9.3M more than Company 3 and $3.5M greater than Company 2. Company 2 will have paid $5.8M more than Company 3, which illustrates the value of not only utilizing third-party advisory support during the negotiation process, but doing so before you begin discussions with Workday.

Future Price Protections – New Workday Solutions

What is not shown in this example that you should also factor in are additional purchases made throughout the relationship. This could be adding quantities to current cloud services to account for growth, adding new cloud services along the way, or most likely a combination of both.

These additional future purchases will likely be in accordance with the previous pricing gap established in Year 1 between the three companies, and possibly even wider gaps if purchased during the subsequent renewal terms. There is much more money to be saved for Company 3 over the 12-year period, as it is an almost certainty that additional purchases will be made over this extended time horizon, so establishing strong pricing terms from the outset is the key to avoid paying more for Workday over time.

The Bottom Line to Avoid Paying More for Workday

Initial pricing and discounting, renewal term protections, and future pricing and discounting protections are critical components to negotiate in any cloud agreement with Workday, but there are others as well. We recommend taking a holistic approach, that includes but also goes beyond pricing and the overall commercial deal construct.

The overall relationship and on-going support from Workday should be factored in to provide a foundation that will better enable you to realize all your business case benefits and extract the most value from your Workday cloud services.

At UpperEdge, we help our customers form strategic relationships with Workday and develop integrated strategies to achieve the best deal possible. Learn more about how we can help.

Related Blogs

From Flat Fees to Growth-Based Pricing: The New Reality of Workday Success Plans

From Announcements to Acquisitions: How Workday’s AI Strategy Should Shape Your Negotiation Approach

Workday’s Latest AI Announcements: What You Need to Know Before Entering the Negotiation Room

About the Author